Beginner's Guide to Real Estate Investing: What You Need to Know

Explore the beginner's guide to real estate investing. Learn the basics, unexpected advantages, and advanced tips for successful property investments.

Real estate investing has long been one of the most reliable and profitable ways to build wealth. Whether you’re looking for a way to generate passive income, diversify your investment portfolio, or secure long-term financial stability, real estate offers numerous opportunities. However, getting started in real estate investing can be intimidating for beginners. From understanding market trends to managing properties, the learning curve may seem steep, but with the right knowledge and strategies, anyone can become a successful real estate investor.

In this comprehensive beginner's guide to real estate investing, we'll explore the fundamentals of real estate investment, discuss its unexpected benefits, and offer advanced tips to help you get started. By the end of this article, you'll have the insights needed to make informed decisions and start your journey toward financial independence through real estate.

Why Invest in Real Estate?

Before we delve into the mechanics of real estate investing, it’s important to understand why this asset class is considered such a powerful tool for building wealth. Here are some of the primary reasons why real estate investing should be on your radar:

- Steady Cash Flow

One of the biggest draws of real estate investment is the potential for steady cash flow. Rental properties, in particular, generate regular income from tenants. Unlike stocks, where income is often tied to dividends, real estate provides a tangible, consistent cash stream that can help cover mortgage payments and other expenses while still delivering profits.

- Appreciation Over Time

Real estate tends to appreciate over time, meaning the value of your property is likely to increase. While markets can fluctuate, real estate has historically shown an upward trajectory in the long term. This makes it an excellent option for investors looking for both short-term income and long-term wealth-building.

Research Insight: According to data from the U.S. Federal Reserve, the median sales price of houses in the U.S. has increased by more than 100% over the last two decades, making it a lucrative investment option.

- Hedge Against Inflation

Real estate is considered an effective hedge against inflation. As the cost of living increases, so do property values and rental income. This means that even during inflationary periods, your investment maintains or even grows in value, while the purchasing power of your money in other asset classes may diminish.

- Tax Benefits

There are several tax advantages to real estate investing. Investors can deduct mortgage interest, property taxes, operating expenses, depreciation, and repairs. Additionally, long-term capital gains from the sale of a property may be taxed at a lower rate than regular income.

Expert Opinion: Real estate expert Grant Cardone emphasizes that understanding tax benefits is crucial for maximizing returns. "Real estate gives you write-offs and depreciation—these tax benefits help you keep more of your profits," Cardone explains.

- Leverage Opportunities

One unique aspect of real estate is the ability to use leverage. By using borrowed money (a mortgage) to purchase a property, you can amplify your returns without needing to invest the full amount upfront. This allows you to control valuable assets with minimal capital, enhancing your overall return on investment (ROI).

Types of Real Estate Investments

There are various ways to invest in real estate, each with its own set of advantages and challenges. Understanding the different types of real estate investments is crucial for determining which strategy aligns best with your goals.

- Rental Properties

Rental properties are one of the most common forms of real estate investment. This involves purchasing residential or commercial properties and renting them out to tenants. The rental income provides steady cash flow, while the property itself appreciates over time.

Advantages:

Steady, passive income

Control over the property and tenants

Long-term appreciation potential

Challenges:

Property management can be time-consuming

Unexpected maintenance costs

Market fluctuations affecting rent prices

- Real Estate Investment Trusts (REITs)

For those looking to invest in real estate without managing physical properties, Real Estate Investment Trusts (REITs) offer a hands-off option. REITs are companies that own, operate, or finance real estate and allow investors to purchase shares, similar to stocks.

Advantages:

Highly liquid and easy to buy/sell

No need to manage properties

Diversification across multiple properties

Challenges:

Less control over the investment

Subject to market volatility like stocks

Dividends may be taxed as ordinary income

- House Flipping

House flipping involves purchasing a property at a low price, renovating it, and selling it for a profit. This strategy can yield significant returns but requires knowledge of the real estate market, renovation costs, and buyer demand.

Advantages:

Potential for high short-term profits

Hands-on involvement in property improvements

Lower capital requirements if using short-term loans

Challenges:

High risk if the property doesn’t sell quickly

Unforeseen renovation costs

Time-consuming process

- Vacation Rentals

Investing in vacation rental properties, particularly in popular tourist destinations, is another way to generate income. Platforms like Airbnb and Vrbo have made it easier for individuals to rent out properties on a short-term basis.

Advantages:

Potential for high rental income in peak seasons

Flexibility to use the property for personal vacations

Ability to charge premium rates for desirable locations

Challenges:

Seasonal fluctuations in income

More frequent tenant turnover

Local regulations may limit short-term rentals

- Real Estate Crowdfunding

Real estate crowdfunding allows individuals to pool their money with other investors to purchase a property. This method gives investors access to larger commercial properties they might not be able to afford on their own.

Advantages:

Lower capital requirement

Access to commercial real estate

Diversified risk across multiple properties

Challenges:

Limited liquidity

Less control over investment decisions

Platform fees may reduce returns

Getting Started: The Basics of Real Estate Investing

Starting your journey into real estate investing requires careful planning and strategy. Here’s a step-by-step guide for beginners looking to make their first investment.

- Assess Your Financial Situation

Before diving into real estate, it’s essential to evaluate your financial standing. Make sure you have a stable income, a good credit score, and enough savings to cover the down payment, closing costs, and potential vacancies or maintenance.

Pro Tip: Aim for at least a 20% down payment on any investment property to avoid private mortgage insurance (PMI) and ensure a better cash flow.

- Choose Your Investment Type

Decide which type of real estate investment aligns with your goals, risk tolerance, and available time. If you want steady income with minimal effort, rental properties or REITs might be ideal. If you prefer higher, short-term returns and enjoy hands-on projects, house flipping could be a better fit.

- Research the Market

Location is one of the most critical factors in real estate investing. Whether you're investing in rental properties, vacation homes, or flipping houses, the property’s location will impact its value, rental demand, and potential for appreciation.

Research Tips:

Look for cities or neighborhoods experiencing population growth, job growth, and infrastructure improvements.

Avoid areas with declining property values or high crime rates.

Pay attention to school districts, access to public transportation, and local amenities, which can affect property desirability.

- Secure Financing

Once you’ve identified a property, securing the right financing is crucial. Explore different loan options, including traditional mortgages, FHA loans, and portfolio loans. If you’re leveraging a property, calculate the mortgage payment, interest rate, and potential rental income to ensure positive cash flow.

Pro Tip: Keep your debt-to-income ratio (DTI) low to qualify for better loan terms. Ideally, your DTI should be under 36%.

- Analyze Potential Returns

Before making an offer, thoroughly analyze the potential returns on your investment. Calculate the expected rental income, operating expenses, property taxes, insurance, and vacancy rates to determine your net operating income (NOI). For house flipping, estimate renovation costs and compare them to potential sale prices in the area.

Key Metrics to Consider:

Cap Rate: Measures the return on investment, calculated by dividing the NOI by the property’s purchase price.

Cash-on-Cash Return: Measures the return on the actual cash invested, including down payments and closing costs.

Gross Rent Multiplier (GRM): Compares the purchase price to the property's rental income.

- Start Small and Scale Gradually

As a beginner, it’s wise to start with a smaller, less risky investment, such as a single-family rental property or investing in REITs. As you gain experience and confidence, you can diversify into larger multifamily properties or more complex investments like house flipping.

Advanced Tips for Real Estate Success

Once you’ve mastered the basics, these advanced strategies can help you take your real estate investments to the next level.

- Diversify Your Portfolio

Diversification is key to minimizing risk and maximizing returns in real estate. Consider investing in different property types (residential, commercial, vacation rentals) and in different geographic locations to spread your risk.

- Leverage Real Estate Partnerships

If you lack the capital or experience for larger investments, consider forming partnerships with other investors. This allows you to pool resources, share responsibilities, and potentially invest in more lucrative properties.

- Keep Up with Market Trends

The real estate market is dynamic, and staying informed is crucial for long-term success. Monitor interest rates, housing supply, and local economic trends to make informed decisions about when to buy, sell, or hold onto properties.

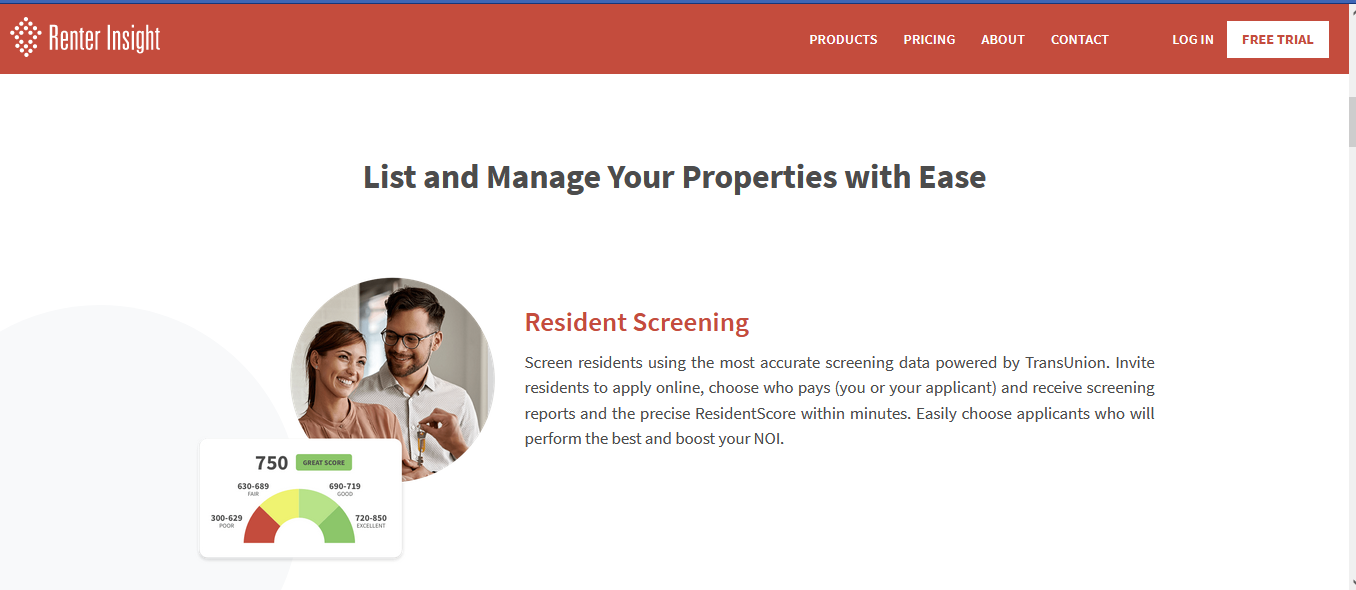

- Focus on Property Management

Effective property management can make or break your investment. If you're managing rental properties, consider hiring a professional property management company to handle tenant relations, maintenance, and rent collection, freeing you up to focus on scaling your portfolio.

- Reinvest Your Profits

As you start generating income from your real estate investments, reinvest the profits to grow your portfolio. Whether it's paying off mortgages faster, purchasing additional properties, or upgrading existing ones, reinvesting ensures compound growth.

Conclusion: Start Your Real Estate Journey Today

Real estate investing offers an incredible opportunity to build wealth, generate passive income, and achieve long-term financial success. Whether you're looking to invest in rental properties, flip houses, or explore REITs, the strategies in this guide provide a solid foundation for getting started.

By following the tips in this beginner’s guide, you’ll be well on your way to making smart, informed decisions that maximize your returns and minimize your risks. Remember, real estate success doesn’t happen overnight, but with careful planning, patience, and persistence, you can build a profitable portfolio that serves you for years to come.

What type of real estate investment are you most interested in? Share your thoughts in the comments below, and let’s discuss!

If you found this article helpful, share it with your friends and followers on social media. Let’s help others start their real estate investing journey!

FAQs

What is the best type of real estate investment for beginners?

Rental properties are often recommended for beginners because they provide steady cash flow and long-term appreciation. However, REITs are a good option for those looking for a more hands-off approach.

How much money do I need to start investing in real estate?

The amount of money needed depends on the type of investment. For a traditional rental property, you typically need at least 20% of the purchase price for a down payment. However, platforms like real estate crowdfunding may allow you to invest with as little as $500.

Is real estate investing risky?

Like any investment, real estate carries some level of risk, including market fluctuations, vacancies, or unexpected repairs. However, proper research, diversification, and prudent financial planning can mitigate these risks.

How can I finance my first real estate investment?

Common financing options include conventional mortgages, FHA loans, and portfolio loans. You can also explore private lenders, hard money loans, or real estate partnerships if you need alternative funding options.

How do I find good investment properties?

To find good investment properties, research local markets, attend real estate networking events, consult with local agents, and use online tools like Zillow or Redfin. Focus on areas with strong economic growth, high rental demand, and reasonable property prices.