Investing for your Future: Get Started Now

Introduction

Investment is the act of putting money or resources into a financial asset or business with the expectation of generating profit or income in the future. The purpose of investment is to grow one's wealth by creating more value from the available resources. Investor aims to increase their wealth by making use of their financial resources, knowledge, and experience to identify and make sound investment decisions.

Investing can take many forms, including stocks, bonds, mutual funds, real estate, commodities, and more. The choice of vehicles depends on the investor's financial goals, risk tolerance, and other personal factors. In general, investments can be classified into two categories: long-term and short-term investments. Long-term investments are those that an investor holds for an extended period, typically years, to achieve a long-term financial goal, such as retirement planning. Short-term investments, on the other hand, are typically held for a shorter duration, often to generate quick returns.

Investment Strategies

Investors typically have a variety of investment strategies that they use to achieve their goals. One strategy is value investing, which involves identifying undervalued stocks or assets with the expectation that their value will increase in the future. Another strategy is growth investing, which focuses on investing in companies with high growth potential investments. The goal is to achieve capital appreciation over the long term by investing in companies with a proven track record of growth.

Risk is an inherent part of investing. An investor must carefully consider the level of risk they are willing to take on when choosing an investment. The higher the risk, the greater the potential reward, but the greater the potential loss. Investors must carefully balance their risk tolerance with their investment goals to make informed investment decisions.

Diversification is an essential part of any investment strategy. By spreading investments across multiple assets and asset classes, investors can reduce their overall risk exposure. Diversification can also help to ensure that investors are not overly exposed to any single investment, reducing the impact of any losses.

Investment performance is typically measured by comparing returns to a benchmark, such as the S&P 500. Returns are calculated as the difference between the initial investment and the final value, including any dividends or other income generated by the investment. The performance of an investment is influenced by a wide range of factors, including economic conditions, market trends, and geopolitical events.

4 Steps to take when investing for your Future

1. How to start investing as soon as possible

Investing is one of the best ways to grow your wealth over time. The earlier you start, the better, as compounding returns can have a significant impact on your overall returns. Here are some steps to get started with investing as soon as possible:

· Educate yourself: Before investing, it is essential to have a basic understanding of different types of investment options, their risks, and returns. Read books, watch videos, and take online courses to improve your knowledge.

· Set your goals: Define your investment goals and objectives. Do you want to invest for short-term or long-term goals, such as saving for a house or retirement?

· Create a budget: Review your monthly expenses and create a budget that allows you to save a portion of your income for investing.

· Open a brokerage account: Once you've saved some money, you can open a brokerage account with a reputable investment company. Compare fees, commission rates, and investment options before choosing a brokerage.

· Choose your investments: Consider investing in diversified investment options, such as mutual funds, exchange-traded funds (ETFs), or index funds. These types of funds invest in a broad range of stocks and bonds to minimize risks.

· Monitor your investments: Keep an eye on your investments and make necessary adjustments when required. Ensure that you rebalance your portfolio periodically to maintain the desired asset allocation.

Investing can be intimidating, but with some basic knowledge and a solid plan, you can start investing as soon as possible to achieve your financial goals. Remember that investing is a long-term strategy, and patience and discipline are key to success.

2. Open an investment account

Opening an investment account can be an important step toward building long-term wealth. With so many different types of investment accounts available, it can be overwhelming to know where to start. Here are some steps you can follow:

· Decide what type of investment account you need: There are various types of investment accounts available, such as individual retirement accounts (IRAs), 401(k)s, brokerage accounts, and more. Determine what type of account aligns with your investment goals.

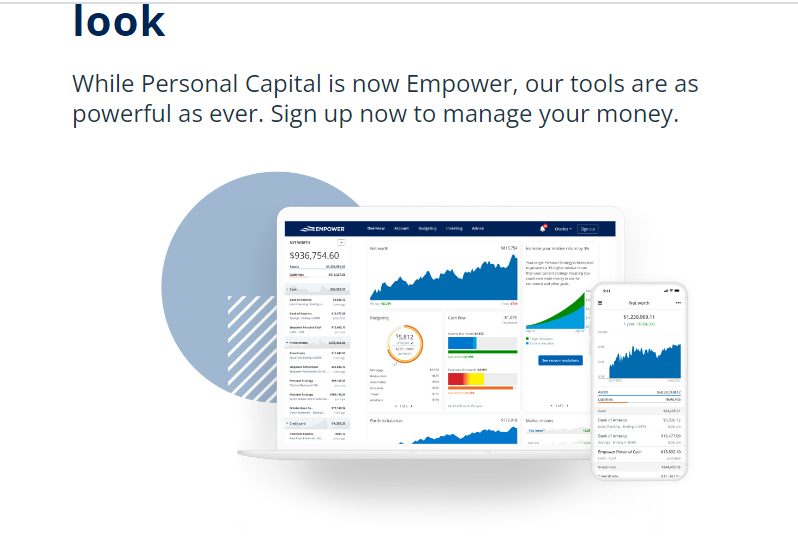

· Research investment firms Look into different investment firms and their offerings. Consider fees, investment options, customer service, and user experience.

· Choose an investment firm: Once you've done your research, select an investment firm that best meets your needs. You can open an account online or by phone.

· Fill out the necessary paperwork: When you open an investment account, you'll need to provide personal information and other details such as your social security number, employment status, and financial information.

· Fund your account: You'll need to transfer funds into your new investment account. You can do this by linking your bank account, wiring money, or mailing a check.

· Start investing: Once your account is set up and funded, you can start investing in the securities of your choice.

Remember that investing involves risk and it's important to understand the potential risks and rewards associated with any investment strategy. Seek professional advice from a financial advisor if you are uncertain about which investment account to choose or how to invest.

3. Pick an Investment Strategy

Picking an investment strategy can be a daunting task, but it's an important one if you want to achieve your financial goals. Here are some steps to consider:

· Define your financial goals: Before you start investing, you should be clear about your financial goals. What are you saving for? Do you have a specific timeframe in mind? How much risk are you willing to take? Having a clear understanding of your goals can help you choose an investment strategy that is best suited for you.

· Assess your risk tolerance: Your risk tolerance is the level of risk you are comfortable taking on. It's important to understand your risk tolerance because it will influence the type of investments you choose. If you are risk-averse, you may prefer conservative investments that offer lower returns but also have a lower risk. On the other hand, if you are comfortable with risk, you may be willing to invest in higher-risk, higher-return investments.

· Choose an investment style: There are several investment styles to choose from, such as value investing, growth investing, income investing, and index investing. Each style has its pros and cons, so you should do your research and choose the one that best aligns with your goals and risk tolerance.

· Diversify your portfolio: Diversification is key to reducing risk in your portfolio. By investing in a mix of asset classes, such as stocks, bonds, and real estate, you can spread out your risk and increase your chances of achieving your financial goals.

· Monitor your investments: Once you've chosen your investment strategy, it's important to monitor your investments regularly to ensure they are performing as expected. You may need to make adjustments over time to keep your portfolio aligned with your goals.

Overall, picking an investment strategy requires a thoughtful and well-informed approach.

4. Understanding your Investment Options

Investment options are financial products that allow individuals and organizations to grow their wealth over time. These options vary in terms of risk, potential return, liquidity, and other factors that investors must consider when deciding where to put their money.

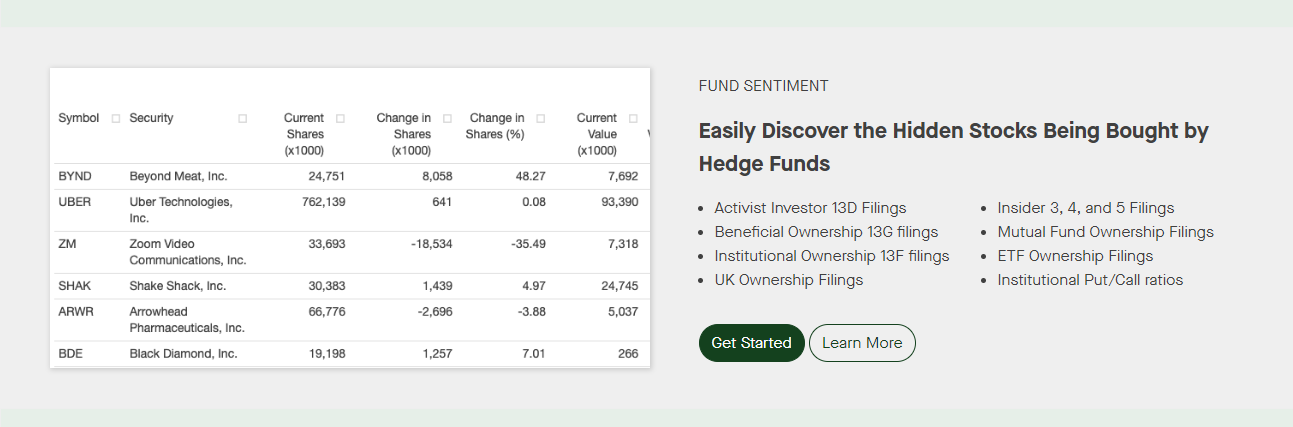

One common investment option is stocks. Stocks represent ownership in a company, and their value can fluctuate based on various factors such as the company's financial performance, industry trends, and macroeconomic conditions. Stocks can offer significant potential returns, but they also come with a high level of risk.

Bonds are another investment option that is typically considered less risky than stocks. When investors purchase bonds, they are essentially loaning money to a company or government entity. In exchange, the investor receives interest payments over time and the return on their principal investment when the bond matures. Bonds can provide a steady stream of income and a level of stability, but the returns are typically lower than stocks.

Real estate is another popular investment option. Investors can buy a property to generate rental income or sell the property for a profit later. Real estate investments require significant capital and ongoing maintenance, but they can provide both cash flow and capital appreciation over time.

Mutual funds and exchange-traded funds (ETFs) are investment options that offer diversification by pooling investors' money into a portfolio of stocks, bonds, or other assets. The fund's value rises and falls with the performance of the underlying assets. Mutual funds are typically actively managed, meaning a professional fund manager selects the assets and makes investment decisions on behalf of the investors. ETFs, on the other hand, are passively managed and seek to match the performance of a market index.

Alternative investments, such as private equity, hedge funds, and commodities, are investment options that fall outside of traditional stocks, bonds, and real estate. These investments can offer unique benefits, such as access to new markets and potentially higher returns. However, they also tend to come with higher fees and greater risk.

Conclusion

Investors have a range of investment options to choose from, each with its benefits and drawbacks. Understanding the risks and potential returns of each option is essential to building a diversified portfolio that meets an individual's financial goals and risk tolerance. Factors to consider include liquidity, fees, past performance, and market trends. It is always recommended to seek professional advice from a financial advisor before making any investment decisions to generate.