Investing in Real Estate vs Stocks: Which One Offers a Better Return on Investment?

Introduction

Real estate and stocks are two of the most popular investment options. While both have the potential for high returns, they have different risk profiles, time horizons, and liquidity. Real estate investments offer tangible assets with the potential for rental income and appreciation but also require high upfront costs and ongoing maintenance. On the other hand, stocks offer greater liquidity, lower barriers to entry, and the ability to diversify investments, but also come with market volatility and uncertainty. Ultimately, the decision between investing in real estate or stocks depends on individual preferences, goals, and risk tolerance.

Real Estate Investing

Investing in real estate involves buying, owning, and managing properties with the expectation of earning a profit. Real estate investing can take various forms, including buying rental properties, flipping homes, investing in REITs (real estate investment trusts), and crowdfunding platforms. In general, real estate investing can be more hands-on than investing in stocks, as it typically requires more effort to find and manage properties, oversee tenants, and handle maintenance and repairs.

Advantages of Real Estate Investing

There are several advantages to investing in real estate, including the following:

1. Cash Flow: One of the most significant advantages of real estate investing is the potential for generating a steady stream of passive income. Rental properties can provide monthly cash flow that can be used to cover expenses or reinvest in additional real estate.

2. Appreciation: Real estate has historically appreciated over time, meaning that the value of a property typically increases as time goes on. This appreciation can lead to significant profits when a property is sold.

3. Tax Benefits: There are several tax benefits associated with real estate investing. Rental property owners can deduct mortgage interest, property taxes, and other expenses from their taxable income, which can significantly reduce their tax liability.

4. Leverage: Real estate is unique in that it can be leveraged, meaning that investors can use borrowed money to purchase properties. This can allow investors to acquire more properties than they could afford to purchase outright.

5. Hedge Against Inflation: Real estate investments can serve as a hedge against inflation, as the value of properties tends to increase as the cost of living rises.

6. Diversification: Real estate investing can provide diversification within an investment portfolio. Real estate investments have a low correlation with other asset classes such as stocks and bonds, meaning that they can help to balance out the risk of a portfolio.

7. Control: Real estate investing provides investors with a high degree of control over their investments. Property owners can make decisions about how to manage their properties and can make improvements to increase their value.

8. Tangible Asset: One of the most significant advantages of real estate investing is that it is a tangible asset that can be seen and touched, making it easier for investors to understand and assess its value. When you invest in a property, you own a physical piece of land and a building that you can see and touch. This can provide a sense of security and stability, as property values tend to appreciate over time.

Risks Associated with Real Estate Investing

Real estate investing can be a lucrative venture, but like any investment, it comes with its share of risks. Here are some of the potential risks associated with real estate investing:

1. Market Risk: Real estate markets can be volatile, and prices can fluctuate rapidly due to various factors such as economic conditions, interest rates, and local factors like supply and demand. Investors who fail to analyze market trends and the local market risks may face significant losses if they buy property at the peak of a market cycle and are forced to sell at a low point.

2. Location Risk: Location is a critical factor in determining the value of a property. Investors may face significant risks if they buy property in a location that is subject to natural disasters or prone to crime. A poor location can also make it difficult to rent or sell the property, leading to lower returns on investment.

3. Financing Risk: Real estate investing often involves borrowing money to purchase a property. Investors who are over-leveraged and cannot meet their mortgage payments may face foreclosure, leading to significant financial losses. Moreover, interest rates on mortgages can increase rapidly, causing financial strain on the investor.

4. Tenant Risk: Rental income is a significant source of revenue for real estate investors. However, tenants can be unreliable, and investors may face difficulty in collecting rent, evicting tenants, or dealing with damages caused to the property. Tenant turnover can also lead to periods of vacancy, reducing rental income.

5. Maintenance and Repair Risk: Real estate investments require regular maintenance and repairs. Failing to budget for these expenses can lead to unexpected costs that can erode profits. Additionally, investors may face liability issues if the property is not maintained to a safe standard.

6. Regulatory Risk: Real estate investments are subject to government regulations, which can change rapidly and have a significant impact on the property's value. Investors need to be aware of zoning laws, building codes, and environmental regulations, which may affect their ability to develop or rent the property.

7. Liquidity Risk: Real estate investments are typically illiquid, meaning that investors may have difficulty selling the property quickly. The longer the property remains on the market, the more significant the opportunity cost and the more powerful the risk of capital loss.

Stock Investing

Investing in stocks involves buying shares of publicly traded companies with the expectation of earning a profit. This can be done through a variety of investment vehicles, such as mutual funds, ETFs (exchange-traded funds), and individual stocks. Stock investing is generally less hands-on than real estate investing, as it can be done online and does not require the same level of property management or maintenance.

Advantages of Stock Investing

Investing in stocks can be a great way to grow wealth over the long term. Here are some advantages of stock investing:

1. Potential for high returns: Stocks have the potential to provide high returns over the long term. Historically, stocks have outperformed other asset classes like bonds and real estate over the long term.

2. Diversification: Investing in stocks can help you diversify your portfolio. This means that you can spread your investment across different companies and sectors, which can help reduce risk.

3. Liquidity: Stocks are highly liquid, meaning that they can be bought and sold quickly and easily. This makes it easy to get in and out of positions as needed.

4. Ownership: When you invest in stocks, you own a part of the company. This means that you can benefit from the company's profits through dividends and capital appreciation.

5. Flexibility: You can invest in stocks through a variety of vehicles, including individual stocks, mutual funds, and exchange-traded funds (ETFs). This gives you flexibility in how you invest in the stock market.

6. Tax advantages: Depending on your investment strategy, there may be tax advantages to investing in stocks. For example, if you hold your stocks for more than a year, you may be eligible for long-term capital gains tax rates, which are typically lower than short-term capital gains tax rates.

Which One Offers a Better Return on Investment?

So, which investment option offers a better return on investment, real estate or stocks? The answer is not so simple, as it depends on a variety of factors, such as the investor's goals, risk tolerance, and investment horizon.

In general, real estate investing can provide a more stable and predictable return on investment, as properties tend to appreciate over time and rental income can provide a steady stream of cash flow. Additionally, real estate investing can provide tax benefits, such as deductions for mortgage interest and property taxes.

On the other hand, stock investing can provide a higher return on investment over the long term, as successful companies tend to grow and increase in value over time. Additionally, stock investing can be more diversified than real estate investing, as investors can buy shares in a variety of industries and sectors.

Ultimately, the best investment option for an individual investor will depend on their personal goals, financial capabilities, etc.

Conclusion

Both investing in real estate and stocks have the potential to offer a good return on investment. However, the choice between the two largely depends on individual preferences, goals, and risk tolerance. Real estate may offer a more stable long-term return on investment and can provide passive income through rental properties. On the other hand, stocks can offer higher returns over a shorter period but are generally more volatile and require active management. Ultimately, diversification is key to managing risk and achieving a balanced portfolio. Therefore, investors should carefully consider their options and consult with a financial advisor before making any investment decisions.

Recommended Offers:

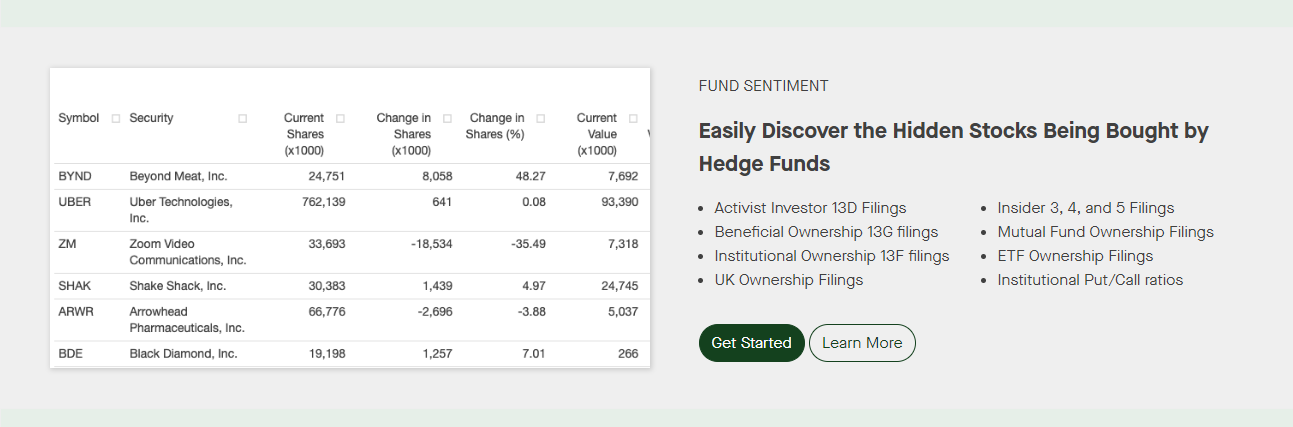

Fintel Cpa

Empower

Emburse

Trustworthy

Getfundsasap.com

Disclosure: Please note that some of the links below are affiliate links at no additional cost to you. We may earn commission from links on this page. When you use one of our affiliate links, the company compensates us, which helps us run this blog and keep all of our in-depth content free of charge for readers (like you) but we only recommend products and services we’ve used and stand behind.