Navigating Payday Loans: How to Borrow Responsibly and Avoid Pitfalls

Navigate payday loans responsibly and avoid pitfalls with practical tips to borrow smartly and protect your financial well-being.

In today's fast-paced financial landscape, many individuals find themselves in need of quick cash to cover unexpected expenses or bridge gaps between paychecks. Enter payday loans, a short-term borrowing option designed to provide immediate funds until the borrower's next payday. While these loans can offer temporary relief, understanding their intricacies and potential pitfalls is essential to navigate them responsibly and avoid financial setbacks.

1. Define Payday Loans and Their Purpose: Payday loans, also known as cash advances or paycheck advances, are small-dollar, short-term loans typically due on the borrower's next payday. They are intended to cover urgent expenses or financial emergencies, such as car repairs, medical bills, or utility payments, when traditional lending options may not be readily available.

Payday lenders often advertise quick approval processes and minimal eligibility requirements, making them appealing to individuals facing immediate financial strain.

2. Highlight the Prevalence of Payday Loan Usage and Its Associated Risks: Despite their convenience, payday loans have become a ubiquitous financial tool for millions of Americans. According to recent studies, an alarming number of individuals rely on payday loans to meet basic needs or cover recurring expenses, highlighting the widespread reliance on this form of borrowing.

However, behind the accessibility and convenience lie significant risks, including exorbitant interest rates, hidden fees, and the potential for borrowers to become trapped in a cycle of debt. Research shows that a substantial percentage of payday loan borrowers struggle to repay their loans on time, leading to costly rollovers and additional fees that exacerbate their financial burden.

3. Set the Tone for the Article by Emphasizing Responsible Borrowing and Avoiding Pitfalls: As we delve into the intricacies of payday loans, it's imperative to underscore the importance of responsible borrowing practices and the need to approach payday loans with caution. While payday loans can offer immediate relief in times of financial strain, they also pose significant risks to borrowers' financial well-being if not managed prudently.

Throughout this article, we'll explore strategies for navigating payday loans responsibly, empowering readers to make informed decisions about their financial futures and avoid falling victim to the pitfalls associated with payday lending.

By understanding the purpose of payday loans, acknowledging their prevalence, and emphasizing the importance of responsible borrowing, readers can embark on a journey of financial literacy and empowerment. Join us as we navigate the complex terrain of payday loans, uncovering insights and strategies to borrow responsibly and safeguard against financial pitfalls.

Understanding Payday Loans

1. How Payday Loans Work: Payday loans are designed to provide quick access to funds for individuals facing immediate financial needs. The application process for a payday loan is typically straightforward and can often be completed online or in person at a payday lending store.

Borrowers are required to provide proof of income, a valid ID, and a post-dated check or authorization for electronic withdrawal from their bank account. Once approved, borrowers receive the loan amount, usually ranging from $100 to $1,000, with the understanding that it must be repaid in full, along with fees, by their next payday.

2. High Interest Rates and Fees: One of the defining characteristics of payday loans is their exorbitant interest rates and fees. Payday lenders often charge fees that equate to an annual percentage rate (APR) of several hundred per cent, making them significantly more expensive than traditional loans or credit cards.

These high costs are justified by the short-term nature of payday loans and the perceived risk of lending to individuals with limited credit history or poor credit scores. Borrowers must carefully review the terms and conditions of payday loans to understand the total cost of borrowing and avoid potential financial pitfalls.

3. Short-Term Nature and Differences from Traditional Loans: Payday loans are intended to be short-term solutions to immediate financial needs, with repayment typically due within two weeks to a month, depending on the borrower's payday cycle. Unlike traditional loans, which may have longer repayment terms and more stringent eligibility criteria, payday loans offer quick access to funds with minimal requirements.

However, this convenience comes at a cost, as borrowers may find themselves trapped in a cycle of debt if they are unable to repay the loan in full by the due date. Additionally, payday loans often do not require a credit check, making them accessible to individuals with poor credit histories but exposing them to higher risks of exploitation by predatory lenders.

Understanding how payday loans operate, including their application process, high interest rates and fees, and short-term nature, is crucial for borrowers to make informed decisions about their financial well-being. By recognizing the risks associated with payday lending and exploring alternative borrowing options, individuals can avoid falling into the trap of predatory lending practices and work towards achieving long-term financial stability.

Risks and Pitfalls of Payday Loans

1. Potential Risks and Pitfalls: Payday loans may offer quick access to cash, but they come with a host of risks and pitfalls that can have long-lasting repercussions on borrowers' financial well-being. One of the most significant dangers associated with payday loans is the cycle of debt they can perpetuate.

Due to their high interest rates and short repayment terms, borrowers often struggle to repay the loan in full by the due date, leading to a cycle of borrowing and repayment that can be difficult to break. This cycle can result in borrowers paying exorbitant fees and interest charges, further exacerbating their financial distress.

Additionally, payday loans often come with rollover fees, which allow borrowers to extend the loan term by paying an additional fee. While this may provide temporary relief, it only prolongs the cycle of debt and increases the total cost of borrowing.

Furthermore, payday loans typically do not require a credit check, meaning borrowers with poor credit histories may still qualify for a loan. However, this accessibility can lead to borrowers taking on more debt than they can afford to repay, putting them at risk of financial instability and further damaging their credit scores.

2. Real-Life Examples and Testimonials: To illustrate the negative consequences of payday loan reliance, consider the following real-life examples:

- Sarah, a single mother struggling to make ends meet, took out a payday loan to cover her rent after losing her job. Despite her efforts to repay the loan on time, she found herself trapped in a cycle of borrowing and repayment, ultimately paying hundreds of dollars in fees and interest charges.

- John, a recent college graduate with limited credit history, turned to payday loans to cover his living expenses while searching for employment. However, the high cost of borrowing quickly became overwhelming, and he found himself drowning in debt with no way out.

- These testimonials highlight the devastating impact payday loans can have on individuals' financial stability and well-being. Borrowers must understand the potential consequences of payday loan reliance and explore alternative borrowing options to avoid falling into a similar predicament.

3. Importance of Understanding Terms and Conditions: Before taking out a payday loan, it's crucial for borrowers to fully understand the terms and conditions of the loan agreement. This includes the total cost of borrowing, including fees and interest rates, as well as the repayment timeline and consequences of default.

Borrowers should carefully review the loan contract and ask questions about any terms or fees they don't understand. By being informed and proactive, borrowers can make responsible borrowing decisions and avoid falling victim to predatory lending practices.

In summary, payday loans pose significant risks and pitfalls to borrowers, including the cycle of debt, rollover fees, and impact on credit scores. Real-life examples highlight the negative consequences of payday loan reliance, underscoring the importance of fully understanding the terms and conditions before taking out a loan.

By recognizing these risks and exploring alternative borrowing options, individuals can protect themselves from financial harm and work towards achieving long-term financial stability.

Responsible Borrowing Practices

1. Alternative Financial Solutions: Instead of resorting to payday loans, borrowers can explore alternative financial solutions that offer more favourable terms and lower risks. One option is to establish an emergency savings fund, setting aside a portion of income each month to cover unexpected expenses or emergencies.

Additionally, personal instalment loans from reputable lenders may provide a more affordable borrowing option, with longer repayment terms and lower interest rates compared to payday loans. Community assistance programs, such as local charities or government agencies, may also offer financial assistance to individuals in need, providing resources and support without the high costs associated with payday lending.

2. Tips for Managing Unexpected Expenses: Managing unexpected expenses without resorting to payday loans requires careful planning and budgeting. By creating a comprehensive budget that accounts for monthly expenses and savings goals, borrowers can identify areas where they can reduce spending or reallocate funds to cover unforeseen costs.

Negotiating payment plans with creditors or service providers may also be an effective strategy for managing expenses, allowing borrowers to spread payments over time without accruing additional debt. Additionally, seeking financial counselling from nonprofit organizations or certified financial planners can provide valuable guidance and support in navigating financial challenges and developing long-term financial strategies.

3. Importance of Building and Maintaining Good Credit: Building and maintaining good credit is essential for accessing more affordable borrowing options and achieving long-term financial stability. By demonstrating responsible borrowing behaviour, such as making timely payments and keeping credit card balances low, borrowers can improve their credit scores over time and qualify for loans with lower interest rates and better terms.

Utilizing credit responsibly and avoiding behaviours that can negatively impact credit scores, such as missing payments or maxing out credit cards, is key to building a solid credit history and accessing more affordable borrowing options in the future.

In summary, responsible borrowing practices involve exploring alternative financial solutions to payday loans, such as emergency savings funds, personal instalment loans, and community assistance programs. Managing unexpected expenses requires budgeting, negotiating payment plans, and seeking financial counselling to develop effective strategies for financial stability.

Additionally, building and maintaining good credit is essential for accessing more affordable borrowing options and achieving long-term financial success. By implementing these practices and avoiding the pitfalls of payday lending, borrowers can protect their financial well-being and work towards a brighter financial future.

How to Borrow Responsibly

1. Strategies for Responsible Borrowing: Borrowing responsibly entails careful consideration and planning to ensure that loans are obtained and managed wisely. Here are some strategies to borrow responsibly:

- Only Borrow What You Need: Before taking out a loan, assess your financial needs and borrow only the amount necessary to cover those expenses. Avoid the temptation to borrow more than you can afford to repay, as this can lead to financial strain and debt accumulation.

- Compare Loan Offers: Research and compare loan offers from multiple lenders to find the most favorable terms and lowest interest rates. Pay close attention to the fine print, including fees, repayment terms, and any penalties for early repayment or late payments.

- Read the Fine Print: Thoroughly review the terms and conditions of any loan agreement before signing. Pay attention to interest rates, fees, repayment schedules, and any other terms that may impact the cost of borrowing. Ask questions and seek clarification on anything you don't understand.

2. Importance of Budgeting and Financial Planning: Budgeting and financial planning are essential tools for avoiding the need for payday loans and managing finances responsibly. Here's why:

- Avoiding Payday Loans: By creating a budget and sticking to it, individuals can allocate funds for essential expenses, savings, and emergencies, reducing the likelihood of needing to resort to payday loans to cover unexpected costs.

- Managing Finances Effectively: Financial planning allows individuals to track their income and expenses, identify areas where they can reduce spending or save money, and set realistic financial goals. By prioritizing savings and building an emergency fund, individuals can mitigate the need for high-cost borrowing options like payday loans.

3. Explore Alternative Sources of Financial Assistance: In addition to traditional lenders, borrowers should explore alternative sources of financial assistance and support. Here are some options to consider:

- Nonprofit Organizations: Many nonprofit organizations offer financial assistance programs, counselling services, and resources to help individuals manage debt, improve financial literacy, and access affordable loans.

- Government Programs: Government agencies may offer assistance programs for individuals facing financial hardship, such as housing assistance, utility bill assistance, and low-income loan programs. These programs can provide valuable support without the high costs associated with payday loans.

By implementing these strategies and exploring alternative sources of financial assistance, individuals can borrow responsibly, avoid the pitfalls of payday loans, and work towards achieving long-term financial stability and security.

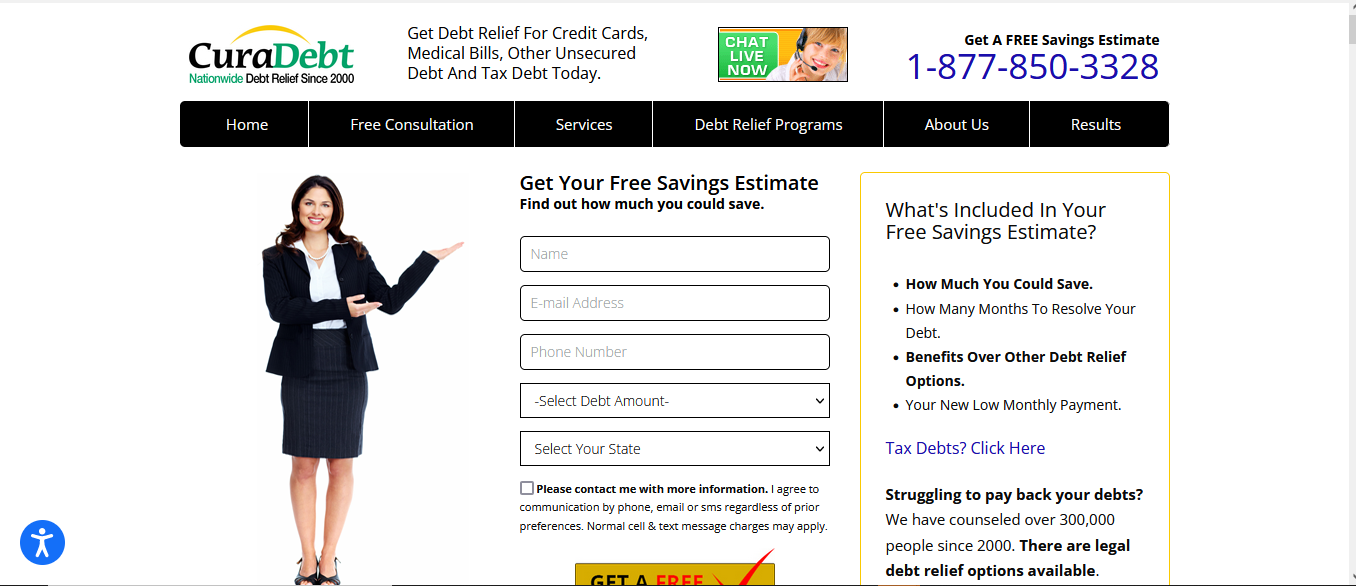

Explore reputable financial assistance programs like CuraDebt, ClearGuide.org, and Kovo Credit for comprehensive debt relief solutions and financial management tools. Take control of your finances today and pave the way towards a more secure tomorrow.

Conclusion

In conclusion, navigating payday loans requires careful consideration and responsible borrowing practices to avoid the potential pitfalls associated with these high-cost, short-term lending options. Throughout this article, we have explored the risks and consequences of payday loans, as well as alternative financial solutions to help individuals manage unexpected expenses and achieve long-term financial stability.

Key Points Summarized:

- Payday loans can lead to a cycle of debt due to their high interest rates and short repayment terms.

- Risks associated with payday loans include rollover fees, impact on credit scores, and the potential for financial hardship.

- Responsible borrowing practices involve only borrowing what is needed, comparing loan offers, and reading the fine print to understand the terms and conditions fully.

- Budgeting and financial planning are essential for avoiding the need for payday loans and managing finances effectively.

- Exploring alternative sources of financial assistance, such as nonprofit organizations and government programs, can provide support without the high costs of payday lending.

As you consider your financial options, I urge you to explore the alternative financial solutions and resources mentioned in this article. Whether it's building an emergency savings fund, seeking assistance from nonprofit organizations, or developing a comprehensive budget, there are many ways to manage unexpected expenses and avoid the need for payday loans. Take proactive steps to protect your financial well-being and explore these options today.

With proper knowledge and planning, individuals can navigate payday loans responsibly and achieve financial stability. By understanding the risks associated with payday lending and adopting responsible borrowing practices, you can make informed decisions about your finances and avoid falling into the cycle of debt. Remember, financial stability is within reach, and by taking proactive steps toward responsible borrowing, you can build a brighter financial future for yourself and your family.

If you found this article helpful, feel free to share it with your friends and followers on social media. Let’s work together to spread knowledge and help others take control of their financial future!