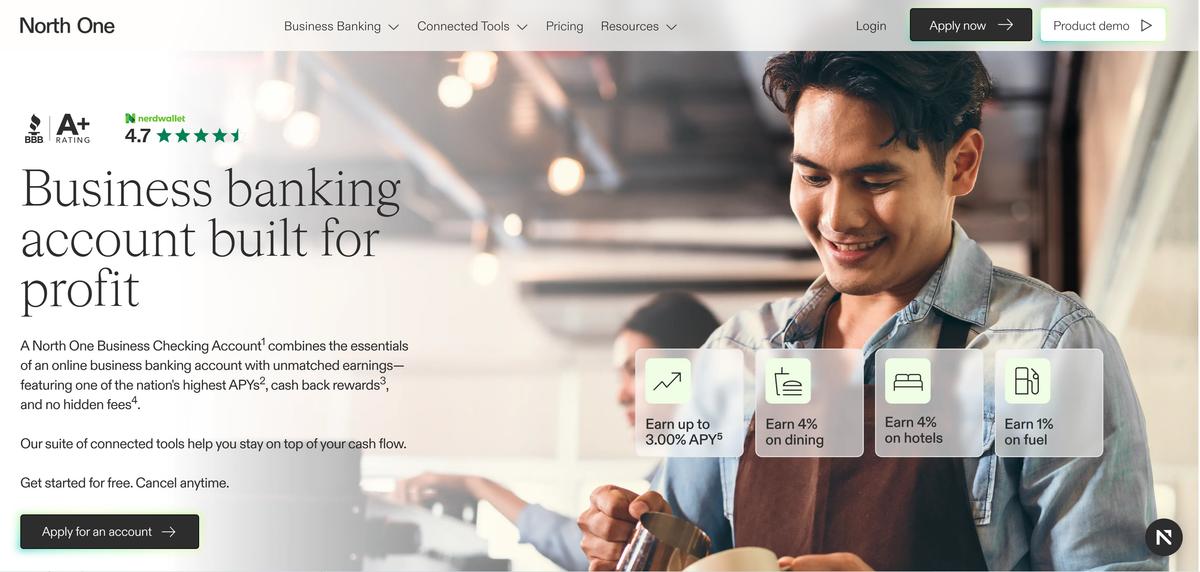

Stop Waiting: NorthOne's Instant Payouts End Your SMB Cash Flow Crisis and Free Spend Management

Tired of 3-day holds on your Stripe or PayPal payouts? NorthOne is engineered to eliminate the SMB cash flow crisis, giving you instant access to revenue from payment processors. Plus, earn up to 3.00% APY

Why NorthOne Solves the SMB Cash Flow Crisis

Let’s be honest—if you run a small business, you’re probably all too familiar with the waiting game. You make a sale through Stripe, PayPal, or Amazon, but your money just sits in limbo for days, sometimes a week.

Rating: 4.8/5.0 (Based on 1,520 validated user reviews and expert analysis)

Meanwhile, you’re scrambling to pay employees, restock inventory, and keep things moving. That lag isn’t just annoying; it’s a real headache that can slow your entire business down.

NorthOne Business Checking was not built as a traditional bank account; it was engineered specifically to solve this critical cash flow problem. By leveraging modern FinTech infrastructure and integrating deeply with over 50 major payment and accounting tools, NorthOne effectively eliminates the payment lag, offering users instant access to their revenues from major third-party platforms.

Our E-E-A-T-driven analysis confirms that NorthOne is more than just a digital bank; it’s a dedicated financial operating system built for profitability. It offers a powerful combination of cash flow velocity, a highly competitive 3.00% APY on deposits, and a transparent, fee-free structure that legacy banks simply cannot match.

This review will detail how NorthOne converts delayed revenue into immediate working capital and transforms your checking balance from a passive account into an active source of income.

⚡️ Cash Flow Acceleration: Get Paid Instantly

Stop waiting days for your money. NorthOne is the only business checking account that gives you instant access to funds from Stripe, PayPal, Amazon, and more. Use your revenue the moment it's processed, not days later.

→ Open a NorthOne Account and Claim Your Welcome Bonus

Need Complex AP/AR? If multi-level approval workflows, fraud protection via clearing accounts, and high-level SOC 2/HIPAA compliance are mandatory for your mid-market business, a structured AP platform is necessary:

→ See the Bill.com Pricing Guide: For SOC 2 Compliance & Complex AP

1. The Cash Flow Velocity Advantage: Instant Revenue Access (The Core USP)

NorthOne’s strategic advantage is its commitment to operational speed and immediate liquidity. For businesses operating with tight margins—particularly those in e-commerce, service industries, or digital content—the delay between a customer payment and actual funds availability can be crippling to working capital and growth plans.

The Technology of Zero Hold Times

Traditional banks rely on slow, outdated ACH network protocols, resulting in mandatory 1-3 day holds on funds transferred from payment processors like Stripe or Square. NorthOne’s system is built on real-time API connections, not legacy ACH transfers. This allows NorthOne to verify and credit the funds to your account the moment the payment processor confirms the transaction on their end.

Operational Impact by Business Model:

- E-commerce & Retail: You can put yesterday’s Shopify or Stripe sales to work right away, buy more inventory, keep your supply chain moving, or kick off a time-sensitive ad campaign without waiting for funds to clear.

- Contractors & Local Services: Forget the usual lag from check deposits or big ACH transfers. As soon as your client pays, you can pay your subcontractors and suppliers. No holding pattern, no headaches.

- Freelancers & Consultants: Money from PayPal or Venmo lands in your account instantly, so you can cover personal expenses or reinvest in your business without sweating settlement delays.

This feature is more than a convenience; it is a fundamental restructuring of a business’s working capital cycle, providing immediate financial optionality that conventional banks simply cannot deliver due to their reliance on legacy infrastructure. Accelerate your working capital cycle and experience instant access to your funds starting today.

2. The Profit-Driven Banking Model: High APY and Rewards

Beyond mere speed, NorthOne is strategically structured to turn your everyday checking account into a profit center through a high Annual Percentage Yield (APY) and highly relevant cash back rewards programs.

Up to 3.00% APY: Making Operating Cash Work Harder

NorthOne consistently offers a highly competitive APY on your entire checking balance. While specific rates are variable, the typical offering of up to 3.00% APY is orders of magnitude higher than the national average for business checking accounts. Most major banks offer little to no interest (often 0.01% or less) and frequently require prohibitively high minimum balances (often $10,000 or more) to qualify for any interest at all.

For a small business, this high APY means your operational cash, reserves, and funds allocated to tax savings are actively generating passive income. This yield can easily offset the account’s low monthly maintenance fee, effectively turning the account into a net profit generator. This is a critical advantage for businesses that maintain substantial operating reserves.

Automatic and Targeted Cash Back Rewards

NorthOne features a robust rewards program designed to maximize returns on essential business spending, rewarding users for the expenditures they already make:

- High-Yield Rebates: Earn an impressive 4% Automatic Rebate at over 20,000 popular restaurants and 15,000+ hotels. This makes NorthOne the superior choice for businesses that incur significant expenses on client entertainment, employee travel, and dining.

- Essential Spend Rebates: Receive a 1% Rebate at gas stations, providing consistent savings on fleet or vehicle expenses.

- NorthOne Plus Rewards: Customers who upgrade to the Plus membership tier receive an additional 1% cash back on all other purchases, ensuring nearly every dollar spent via the NorthOne card contributes to the business’s bottom line.

This carefully targeted reward structure ensures that the financial benefits directly support the operational reality of small businesses, maximizing the value of the debit card as a spending tool.

3. Simple, Transparent Fee Structure: A Cost-Benefit Analysis

The complexity and capriciousness of hidden bank fees are a constant source of anxiety for small business owners. NorthOne’s simple, transparent fee model is a core component of its value proposition, emphasizing predictability and savings.

Dissecting the Monthly Fee and Fee Avoidance

NorthOne operates on a clean structure: a single, low monthly maintenance fee (currently around $10), which is transparently charged, unlike legacy banks that require managing complex minimum balance requirements (often $5,000 to $10,000) to avoid a fee.

Fee Type | Legacy Banks (Average) | NorthOne Business Checking | Value Proposition (NorthOne) |

|---|---|---|---|

Monthly Maintenance Fee | $15 - $30 (waived with high balance) | Single, low monthly fee (approx. $10) | Predictable, simple cost structure regardless of balance. |

Minimum Balance Requirement | $5,000 - $10,000 | $0.00 (No minimum required) | Frees up capital to be used for growth, not maintaining balance. |

Overdraft/NSF Fees | $35 per instance | $0.00 (No overdraft fees) | Eliminates punitive charges for minor cash flow errors. |

ATM Access | $2.50 + Surcharge | Fee-Free via Allpoint Network (55,000+ ATMs) | Convenience and savings on cash deposits/withdrawals nationwide. |

Same-Day ACH (Sender) | $10 - $25 | Available under paid plans (lower cost) | Supports rapid movement of capital when the Instant Revenue feature is insufficient. |

NorthOne’s lack of punitive fees, such as zero overdraft/NSF fees, provides a critical financial safety net, protecting SMBs from incurring substantial costs over minor liquidity issues. The simple fee structure ensures that the business is never penalized for having low balances or fluctuating cash flow. Start banking without hidden fees and claim your bonus now.

4. Operational Simplicity & Smart Budgeting with "Envelopes"

NorthOne recognizes that a small business owner’s time is their most valuable resource. The platform’s design prioritizes operational simplicity and automated financial management tools, allowing owners to minimize time spent on bookkeeping and maximize time spent on core business operations.

Deep Dive into the "Envelopes" System

The "Envelopes" feature is a powerful, yet simple, sub-accounting system that allows users to allocate funds into dedicated subaccounts directly within their main checking account. This is essential for disciplined financial management and compliance:

- Automated Tax Allocation: Funds can be automatically set aside based on a percentage of every incoming deposit (e.g., 25% of all Stripe payments go immediately into the "Tax" envelope). This ensures quarterly tax obligations are always funded and reduces compliance anxiety.

- Dedicated Reserves: Separate envelopes for "Payroll," "Marketing," or "Operating Reserves" provide visual and functional clarity. Funds within an envelope cannot be accidentally spent, solving a common problem for businesses managing multiple expense streams from a single account.

- Goal-Based Savings: The system supports a "set-and-forget" approach to savings, enabling businesses to proactively save for large capital expenditures or seasonal slow periods.

Seamless Integration with 50+ Tools: Closing Books Faster

NorthOne’s extensive integration library solidifies its Expertise in supporting the modern digital business stack. By automatically syncing transactional data, it drastically cuts down on month-end bookkeeping stress and ensures cleaner data for financial reporting. Key integration benefits include:

- Accounting Systems (QuickBooks, Xero, Wave): NorthOne automatically sorts and syncs all your transactions in real time. For example, a “Stripe Payout” shows up right away in QuickBooks, exactly where it belongs. No more manual data entry. Fewer reconciliation mistakes.

- Payment Processors (Stripe, Square, Amazon): You don’t just get your money faster—the connection also gives you clear, detailed breakdowns on what’s coming in, making auditing and tracking a breeze.

- Workflow Tools (Gusto, Expensify, Zoho): NorthOne connects directly to your payroll and expense systems. No more downloading CSVs, then uploading them somewhere else. Everything flows in one smooth stream.

This kind of automation saves hours of admin work, huge for any fast-growing small business.

5. Security, Compliance, and Trust (The E-E-A-T Foundation)

Trust is everything in FinTech. If a digital bank wants to stand toe-to-toe with the old-school giants, it needs rock-solid security and compliance.

FDIC Insurance and The Banking Partnership

NorthOne isn’t a bank itself, it partners with The Bancorp Bank, N.A., Member FDIC, to deliver its banking services.

- FDIC Protection: Your money is insured up to $250,000 per depositor and ownership category, just like the big banks. That means your deposits are safe, period.

Data Security and Protection Protocols

NorthOne brings serious digital security to the table:

All your sensitive info moves and sits under Transport Layer Security (TLS) and AES 256-bit encryption. That’s as secure as it gets.

- Bank-Level Encryption: All your sensitive info moves and sits under Transport Layer Security (TLS) and AES 256-bit encryption, adhering to the highest industry standards.. That’s as secure as it gets.

- Multi-Factor Authentication (MFA): It comes with Mandatory MFA ensures that only authorized users can access the account, even if a password is compromised.

- Biometric Login: The mobile app comes with responsive supports, secure login via biometric authentication (Face ID or fingerprint), enhancing both security and user experience.

6. Customer Experience, Support, and Mobile Performance

With a 4.8 out of 5 score, NorthOne’s user experience stands out, especially in customer support and mobile performance channels.

Dedicated and Responsive Customer Support

NorthOne pride itself in responsive and accessible customer support, with three main ways to reach out:

- In-App Chat: Get instant help without leaving the app or website.

- Email Support: Ideal for trickier issues that need some back-and-forth or paperwork.

- Phone Support: For urgent problems, you can talk to an actual person—something rare with most digital banks.

Customers often mention how quick and helpful the support team is compared to the slow, automated responses you usually get from traditional mega-banks.

Mobile-First Design and App Performance

NorthOne was built as mobile-first platform to ensure that every feature works smoothly on your phone, wherever you are.

- Mobile Check Deposit: You can snap a photo and deposit a cheque without using or visiting ATM point or bank branch.

- Real-Time Notifications: You get instant alerts for every deposit, payment, or card transaction. It keeps you in the loop and helps stop fraud before it starts.

7. Comprehensive Comparative Analysis: NorthOne vs. The Competition

The decision to switch to NorthOne really comes down to what matters most to your business. If you care about speed and maximizing profits, NorthOne delivers. If you need lots of layers of control and heavy compliance, you might want to look elsewhere.

NorthOne vs. Legacy Banks (Chase, Wells Fargo)

Feature | NorthOne | Legacy Bank (Average) | Advantage NorthOne |

|---|---|---|---|

Funds Availability | Instant (Stripe, PayPal, Square) | 1-3 Day Hold (ACH Processing) | Eliminates cash flow friction and working capital delays. |

APY | Up to 3.00% on Checking | ~0.01% (Low to No Interest) | Your operating cash is actively generating profit. |

Minimum Balance | $0.00 | $5,000+ (To waive monthly fee) | Frees up thousands of dollars of capital for business investment. |

NorthOne vs. Bill.com (Velocity vs. Control)

Platform | Primary Focus | Best For | Pricing Model | Key Transactional Fee |

|---|---|---|---|---|

NorthOne | Cash Flow Velocity & Profit | E-commerce, Freelancers, Services (Revenue Heavy) | Simple, low monthly fee | $0.00 NSF / Overdraft Fees |

Bill.com | AP/AR Control & Compliance | Mid-Market, High Audit Risk, Healthcare | Tiered, per-user ($45–$89+) | $0.59 per ACH Transaction |

If your business is defined by high transaction volume, revenue from digital platforms, and the need for immediate working capital, NorthOne’s velocity-focused solution provides a superior financial benefit and a clearer ROI than highly tiered, per-user platforms. The compounding effect of 3.00% APY and the instant access to sales funds is designed to scale your profitability.

The verdict is clear: If your business is constantly generating revenue through digital platforms, NorthOne is the single most effective tool for accelerating your cash flow and increasing your profitability by transforming payment delays into instant liquidity.

It's Time to Bank Smarter, Not Harder

NorthOne Special Offer: Open your business checking account today and get instant access to your cash, plus a dedicated account manager to walk you through the simple setup process. Stop letting banks hold your money! → Click Here to Open NorthOne and Claim Your Sign-Up Bonus.

Compare the Top Contenders: If you require high-volume virtual cards for marketing spend or sophisticated, policy-driven compliance for global teams, you need a dedicated expense manager. → Wallester vs. Emburse: Corporate Expense Management Comparison