The Definitive 2025 Bill.com Pricing Guide: Tiers, Fees, Your True ROI and Free Spend Management

Bill.com's tiered pricing is complex, often concealing per-transaction fees that can cost thousands annually. Our definitive guide breaks down every tier, exposes the hidden charges, and rigorously analyzes the true ROI of AP automation for compliance-focused finance teams.

Why Bill.com Pricing is Complex (And Why It Matters)

Bill.com has cemented itself as a dominant player in the mid-market Accounts Payable (AP) and Accounts Receivable (AR) automation space. Its feature set, including advanced approval workflows, seamless accounting integrations, and enhanced security, justifies its premium positioning within the FINtech industry.

Rating: 4.2 / 5.0★★★★☆ (Based on 248 validated user and expert reviews)

- ACH Payments: $0.59 per transaction.

- Instant Transfers: 1.0% fee (with a $1.00 minimum).

- Vendor Credit Card Payments: A substantial 2.9% transaction fee.

However, prospective users consistently encounter two core pain points: the initial confusion over Bill.com’s two distinct product ecosystems and the lack of transparency around mandatory, high-volume transactional fees that can quickly inflate monthly costs.

Our E-E-A-T-driven analysis cuts through the marketing language to provide a comprehensive breakdown of the true, all-in cost of using Bill.com, ensuring you understand not just the subscription price but the operational costs of every payment you process.

🔥 Editor's Choice: Secure Your FinTech Solution

Bill.com is the industry leader for SOC 2 and HIPAA compliant AP/AR automation. Get a full demo of their Corporate tier and secure special pricing for your mid-market business.

→ Click Here to Request Your Bill.com Demo and Secure Pricing

Cash Flow Alternative: If immediate liquidity and instant access to funds (Stripe, PayPal) are your top priority over complex workflows:

1. The Two Bill.com Ecosystems Explained

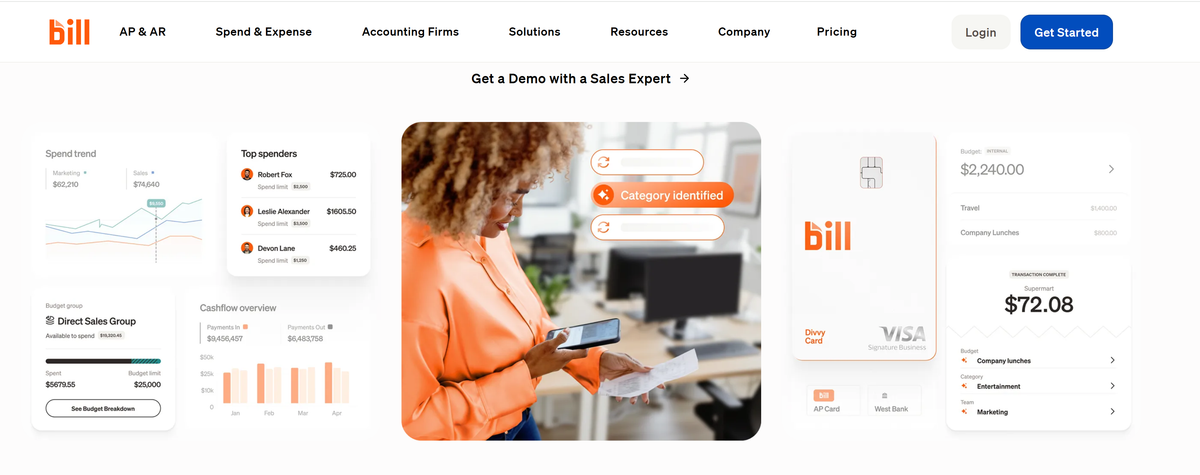

To accurately calculate your Total Cost of Ownership (TCO), you must first separate Bill.com into its two primary, yet independently priced, product lines: the Core AP/AR Automation Platform and the Bill Spend & Expense Platform (formerly known as Divvy).

A. Core AP/AR Automation: The Paid, Tiered Workflow Engine

This is the traditional, subscription-based Bill.com platform. It is designed for businesses requiring rigorous, controlled workflows to manage incoming bills (AP) and outgoing invoices (AR).

Key Functions:

- Multi-level approval routings for bills and invoices.

- It comes with customized roles and permissions for multiple users.

- It supports two-way synchronisation with accounting software (QuickBooks, Xero, NetSuite).

- Deep, two-way synchronization with accounting software (QuickBooks, Xero, NetSuite).

- Check, ACH, and International wire payment initiation.

Pricing Model: The Core AP/AR product is priced per user, per month, making it significantly more expensive as your team and internal financial controls grow. This is where the bulk of your subscription cost will reside.

B. Bill Spend & Expense (Divvy): The Free Corporate Card Solution

In a strategic move to capture market share, Bill.com offers a separate, full-featured corporate card and expense management platform at no monthly cost.

Key Functions:

- Physical and virtual card issuance with built-in spending limits.

- Real-time budget control (Spend Management).

- Automated expense reporting and receipt capture.

- Rewards program that allows companies to earn cash back or travel points on spend.

Pricing Model: The Spend & Expense platform is FREE to use. Bill.com generates revenue on this product through interchange fees (a small percentage of every card swipe paid by the merchant), not by charging the user a subscription fee. This makes it an ideal, no-cost entry point into the Bill.com ecosystem. You can sign up for the free Bill Spend & Expense card program here.

2. The True Cost of Automation: Dissecting the Fee Structure

The greatest surprise for new Bill.com users is often not the monthly subscription cost but the accumulation of mandatory transactional fees. If your business processes high volumes of payments, these charges will quickly outweigh the subscription fees.

Core AP/AR Subscription Tiers (Per User, Per Month)

Bill.com requires you to choose a tier based on the level of control and number of users you need. The prices below represent the standard published rates as of late 2024.

Tier Name | Key Features | Price (Per User/Month) | Target User Profile |

|---|---|---|---|

Essentials | Bill entry, approval workflows, QuickBooks/Xero sync (Basic AP/AR) | $45 | Startups, Small Businesses (Low User Count) |

Team | Essential features + unlimited users, custom roles, up to 2 approvers | $55 | Growing SMBs require role-based access control |

Corporate | Team features + advanced controls, 2-way sync, purchase order matching | $89+ | Mid-Market, Enterprises, High Audit Risk Businesses |

Crucial Insight: The "unlimited users" feature in the Team tier is misleading. While you may have unlimited viewers or payees, the $55/user fee applies to all active users who initiate, approve, or manage bills, ensuring the cost scales significantly with your team size. Ready to choose your core AP/AR tier? Get started here.

Mandatory Transactional Fees (The Hidden Costs)

These fees are charged per event and are separate from your monthly subscription. They are the key determinant of your actual TCO, especially if you rely heavily on fast or electronic payment methods.

1. ACH Payments (E-Cheques) - The Volume Cost

- Standard Cost: $0.59 per transaction.

- Zero-Cost Exception: If the payment recipient (vendor) is also an active, paying subscriber to Bill.com, the transaction is often free for the sender. This incentivizes a network effect but penalizes businesses paying non-users.

- Impact: If your business processes 500 ACH payments monthly, this single fee adds $295 to your operational costs, regardless of your subscription tier.

2. Instant Transfers - The Liquidity Tax

- Cost: 1.0% fee per withdrawal, with a minimum charge of $1.00.

- Context: This fee applies when you need to immediately withdraw funds or accelerate payment processing times (often the Instant Pay feature).

- Impact: While convenient for rapid cash flow needs, a single $10,000 instant transfer will cost you $100.00 in fees, a cost that can often be avoided with advanced planning using standard ACH.

3. Vendor Credit Card Payments – The High-Cost Convenience

- Cost: A significant 2.9% transaction fee.

- Context: This fee is incurred when you use Bill.com to pay a vendor (who does not accept credit cards) via cheque, and you fund that payment using your own credit card.

- Impact: This is a costly convenience. For example, paying a $5,000 invoice via your credit card through the platform incurs $145.00 in Bill.com fees, on top of any interest your card may charge.

4. Cheque Payments and Security Fees

- Cheque Printing & Mailing: Approximately $1.50 per cheque. This is standard across most AP platforms.

- International Wires: While Bill.com advertises $0 wire transfer fees for payments made in local currency, the actual cost is embedded in the competitive currency conversion rate (FX spread) they apply at the time of the transaction. Transparency is required, but comparing the FX rate against banks is essential.

3. Built for Scale: Security, Compliance, and Audit Readiness

The high subscription price of the Core AP/AR platform is largely justified by its rigorous adherence to critical security and regulatory compliance standards, establishing the high level of Trust required for E-E-A-T in the financial sector.

A. AICPA SOC 1 & SOC 2 Type II Compliance

This is the non-negotiable standard for any platform handling sensitive financial data for mid-market and enterprise clients.

- SOC 1 (Type II): Focuses on controls relevant to financial reporting.

- SOC 2 (Type II): Focuses on controls relevant to security, availability, processing integrity, confidentiality, and privacy.

Why This Matters: Bill.com’s compliance confirms that its internal controls and security mechanisms have been rigorously tested by a third-party auditor over a sustained period. This significantly reduces the audit risk for any company using the platform to manage its AP/AR functions, making it a critical differentiator over less compliant, cheaper alternatives.

B. HIPAA and Protected Health Information (ePHI)

For organizations operating in the healthcare sector (such as medical practices, hospitals, or specialized vendors), the handling of electronic Protected Health Information (ePHI) is mandated by HIPAA. Bill.com provides specific safeguards and features to maintain HIPAA compliance.

This often overlooked feature confirms that the platform can securely handle financial documents that may contain sensitive health data, such as invoices related to medical services. This capability instantly qualifies Bill.com for a sector where most generalized accounting platforms would fail strict compliance checks.

C. Enhanced Fraud Prevention: The Clearing Account

A critical security feature utilized by Bill.com is the use of a clearing account to issue payments. When Bill.com cuts a physical cheque or issues an ACH, it originates from their clearing account, not your company's primary bank account.

This mechanism acts as a robust form of fraud protection, similar to Positive Pay services offered by banks (which often come with separate fees). By hiding your main bank details from vendors, you dramatically reduce the risk of cheque washing, fraudulent ACH transfers, and unauthorized account debits.

4. Final Verdict and Strategic Recommendation

Bill.com is not the most cost-effective platform for every business, but it is one of the most powerful and secure for those who need absolute control and compliance.

Bill.com is the Right Choice If:

- You require multi-level approval workflows (3+ steps) and custom user roles.

- You operate in a highly regulated industry (like Healthcare) and need SOC 2 Type II or HIPAA compliance.

- Your accounting team is concerned with fraud and requires the enhanced security of the clearing account/Positive Pay mechanism.

- You use Bill Spend & Expense (Divvy) and require a fully integrated, card-based solution with your AP platform.

Bill.com May Be Too Expensive If:

- You process a high volume of ACH transactions for non-Bill.com users (the $0.59 fee will accumulate quickly).

- You are a small business (SMB) with less than 50 bills per month, where a single-fee accounting platform (like QuickBooks Advanced) may offer better value.

- Your primary need is cash flow velocity (instant deposits from Stripe/PayPal), a feature better addressed by modern digital banks like NorthOne. If instant liquidity is your top priority, we strongly recommend reading our in-depth NorthOne Business Checking review here.

The core financial decision comes down to the trade-off: Are you willing to pay a premium subscription and transactional fee structure for demonstrably higher security, compliance, and workflow control? For mid-market companies facing audits and complex spend management, the answer is unequivocally yes.

Ready to Upgrade Your Financial Control?

Go With the Compliant Leader Implement Bill.com's Core AP/AR for the best compliance and audit trail features. → Start Your Free Trial of Bill.com Today