The Pros and Cons of Buying vs. Renting a Home

I. Introduction

The decision to buy or rent a home is one of the most significant financial choices many individuals will make in their lives. There are many factors to consider when deciding whether to buy or rent a home, including upfront costs, ongoing expenses, long-term financial implications, and personal preferences. In this article, we will explore the pros and cons of buying vs. renting a home, helping you make an informed decision based on your specific circumstances.

II. The Pros of Buying a Home

· Equity Building

One of the most significant advantages of buying a home is the opportunity to build equity over time. Equity is the difference between the market value of your home and the amount you owe on your mortgage. As you pay down your mortgage, your equity increases, providing you with a valuable asset that can be used for other investments or to finance future home purchases.

· Control Over Property

When you own a home, you have complete control over the property. You can make modifications, renovations, and upgrades as you see fit, without needing the permission of a landlord. You can also choose to rent out part or all of your property to generate additional income.

· Tax Benefits

Homeownership comes with several tax benefits, including the ability to deduct mortgage interest and property taxes from your income taxes. These deductions can provide substantial savings, particularly in the early years of homeownership when the bulk of your monthly mortgage payment goes toward interest.

· Potential for Appreciation

Historically, home prices in the United States have increased over time, providing homeowners with the potential for appreciation. While there is no guarantee that your home will increase in value, owning a home in a desirable area can be an excellent long-term investment.

III. The Cons of Buying a Home

· High Upfront Costs

The upfront costs of buying a home can be substantial, including the down payment, closing costs, and other fees. Depending on the purchase price of the home, these costs can add up to tens of thousands of dollars, making it difficult for some individuals to afford homeownership.

· Potential for Loss of Value

While home prices have historically increased over time, there is no guarantee that this trend will continue. Economic factors, changes in the local housing market, and other variables can cause home values to decrease, potentially resulting in a loss of equity.

· Responsibility for Maintenance and Repairs

As a homeowner, you are responsible for maintaining and repairing your property, which can be time-consuming and expensive. This includes everything from fixing leaky faucets to replacing the roof, and it can add up to thousands of dollars in expenses each year.

· Reduced Flexibility

Reduced flexibility is one of the cons of buying a home. When you purchase a property, you become responsible for it, and it can be challenging to sell or move out quickly. If you need to relocate for a job, family, or any other reason, you may have difficulty selling your home at a reasonable price. Additionally, you may face financial losses if you sell your home too soon after purchasing it. Homeownership can also tie up a significant portion of your finances, limiting your ability to make other investments or pursue other opportunities. Overall, reduced flexibility is a significant consideration when deciding whether to buy a home.

IV. The Pros of Renting a Home

· Lower Upfront Cost

Lower upfront costs are one of the key benefits of renting a home. When you rent, you typically do not have to come up with a large down payment or pay for the upfront costs associated with buying a home, such as closing costs, inspections, and appraisal fees. Instead, you typically only have to pay a security deposit and the first month's rent. This can make it easier to move into a new home, especially if you are on a tight budget or do not have significant savings. Additionally, renting allows you to avoid the ongoing expenses of homeownership, such as property taxes, maintenance, and repairs.

· Less Responsibility for Maintenance and Repairs

One of the advantages of renting a home is that tenants typically have less responsibility for maintenance and repairs. Landlords are usually responsible for major repairs and upgrades to the property, such as fixing a leaky roof or replacing a broken appliance. This can save tenants time and money, as they don't have to worry about finding a reliable contractor or paying for expensive repairs themselves. Additionally, landlords are often required by law to maintain a safe and habitable living environment for their tenants, so renters can rest assured that their living space is up to code and safe to occupy.

· Greater Flexibility

Greater flexibility is one of the main benefits of renting a home. Renting allows individuals to have more freedom to move from one place to another without being tied down to a long-term mortgage. Renters can easily relocate for job opportunities, family changes, or simply a change of scenery. Additionally, renting allows for greater flexibility in terms of lifestyle changes. For example, renters may be able to move into a larger or smaller space as their needs change. Renting also provides more flexibility in terms of maintenance and repairs, as these responsibilities are typically handled by the landlord or property management company. Overall, renting provides a level of flexibility that homeownership does not.

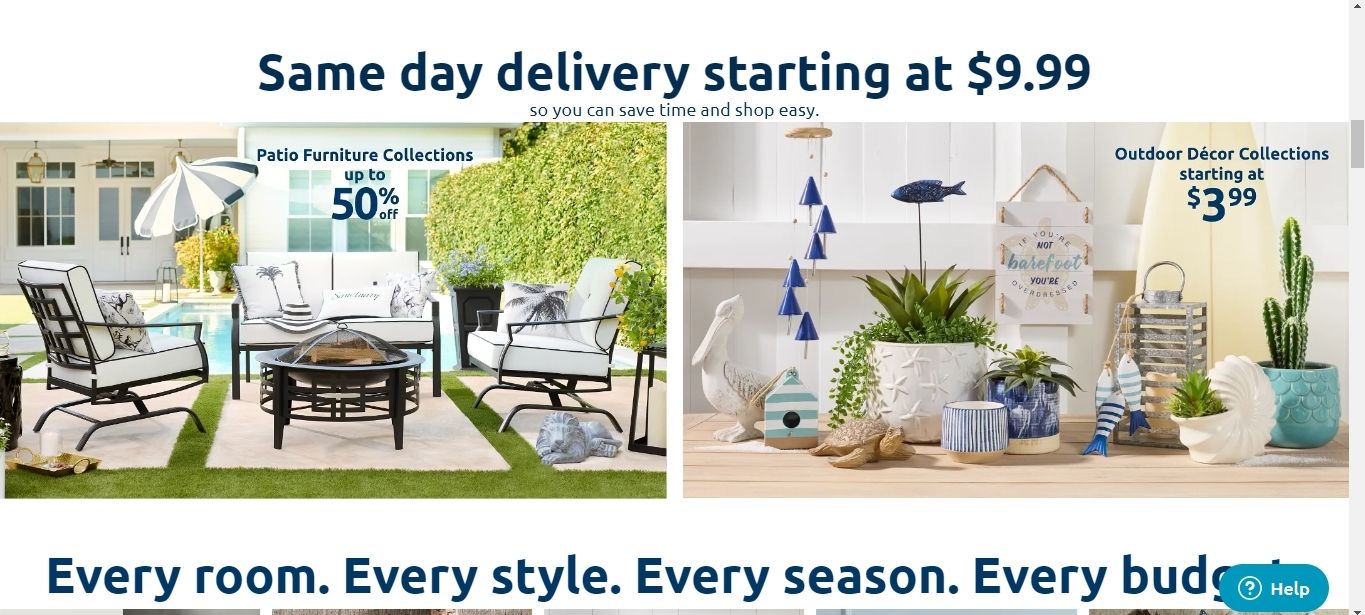

· Access to Amenities

Access to amenities is a key benefit of renting a home. Many rental property centres offer amenities such as pools, gyms, and communal spaces that would be difficult or expensive to access in a home you own. Renters can also benefit from on-site maintenance and security. Additionally, renting can provide greater flexibility to live in areas with high home prices, allowing renters to access amenities such as schools, parks, and shopping centres. This can be particularly beneficial for those who are not yet ready or able to commit to buying a home. Overall, renting can provide access to a wide range of amenities that can improve quality of life.

V. The Cons of Renting a Home

· Lack of Equity Building

One of the main cons of renting a home is the lack of equity building. Unlike homeownership, where the monthly mortgage payments contribute towards building equity and eventual ownership of the property, renting does not offer any such benefit. When renting, the money paid towards rent is essentially lost as it does not result in any long-term asset building or ownership. This can be especially problematic in areas where rent is high, as it can limit the ability to save money towards a down payment for a future home purchase. Additionally, renters may face increased costs as landlords may raise rent prices or charge additional fees for maintenance and repairs.

· Limited Control Over Property

One of the cons of renting a home is limited control over the property. As a tenant, you are restricted in what you can do with the property, such as making significant changes to the structure or design. Additionally, you may have to obtain permission from the landlord to perform certain activities, such as painting the walls or installing a new appliance. Renting also means you have limited ability to personalize the property to your liking. Moreover, you may have to adhere to certain rules and regulations set by the landlord, which could limit your freedom to use the property as you, please.

· No Tax Benefits

One of the cons of renting a home is that there are no tax benefits. Unlike homeowners, renters cannot deduct their rent payments from their federal income taxes. Homeowners can deduct their mortgage interest and property taxes, which can significantly reduce their tax liability. Additionally, homeowners can deduct the costs associated with home maintenance and repairs, which renters cannot. Renters may be able to deduct some expenses related to their rental property if they operate a business from their rental or have a home office, but these deductions are generally limited. Overall, the lack of tax benefits is a disadvantage of renting a home compared to owning one.

· Rent Increases

One of the cons of renting a home is the possibility of rent increases. Landlords can raise the rent at the end of a lease term or during a month-to-month rental agreement, depending on the terms of the rental agreement and local laws. Rent increases can be difficult for renters to manage, especially if their income doesn't keep pace with rising housing costs. This can lead to financial strain and potentially force renters to move to a more affordable home or area. Renters should carefully review their rental agreement and understand their rights and options in the event of a rent increase.

Conclusion

The decision to buy or rent a home is a complex one that requires careful consideration of the pros and cons. Buying a home offers the advantages of building equity, the potential appreciation in value, and greater control over one's living space. However, it also comes with the responsibilities of maintaining the property and the risks of a fluctuating housing market. Renting, on the other hand, provides flexibility and often requires less financial commitment upfront, but may limit long-term financial growth and the ability to personalize living space. Ultimately, the decision should be based on individual circumstances and priorities, taking into account factors such as financial situation, lifestyle, and plans.