Wallester Review 2025 (4.9/5): The All-in-One Corporate Card for Smarter Spending

Wallester offers corporate cards, expense management software, and instant virtual card issuance for FinTech's. Whether you're a media buyer scaling campaigns, a finance manager automating expenses, learn how our platform automates spending control for modern businesses.

Executive Summary

Wallester isn’t just another company card solution; it’s pretty much the Swiss Army knife for modern businesses, minus the airport drama. If you’re tired of chasing down receipts and dealing with expense reports that make your eyes glaze over, this is your answer. Wallester?

Overall Rating: ★★★★★ (4.9/5)

Best for: Media buyers, finance managers, and fintech developers seeking flexible, API-driven virtual cards with transparent pricing.

Instantly. APIs that won’t make your tech team mutter under their breath? Actually, yes. And the pricing? Transparent enough that you’re not left scratching your head at the end of the month.

Whether you’re in media buying, finance, or building the next big fintech tool, Wallester covers all bases. You get real-time expense tracking, customizable spending controls (so your budget doesn’t mysteriously vanish), and easy integration with your existing accounting systems, no rocket science required.

Introduction

Transform Your Corporate Spending With Wallester

Whether you're managing ad spend, overseeing finances, or building out fintech solutions, Wallester brings serious speed, control, and flexibility to the table. Pricing’s crystal clear—no hidden fees lurking in the fine print.

What is Wallester?

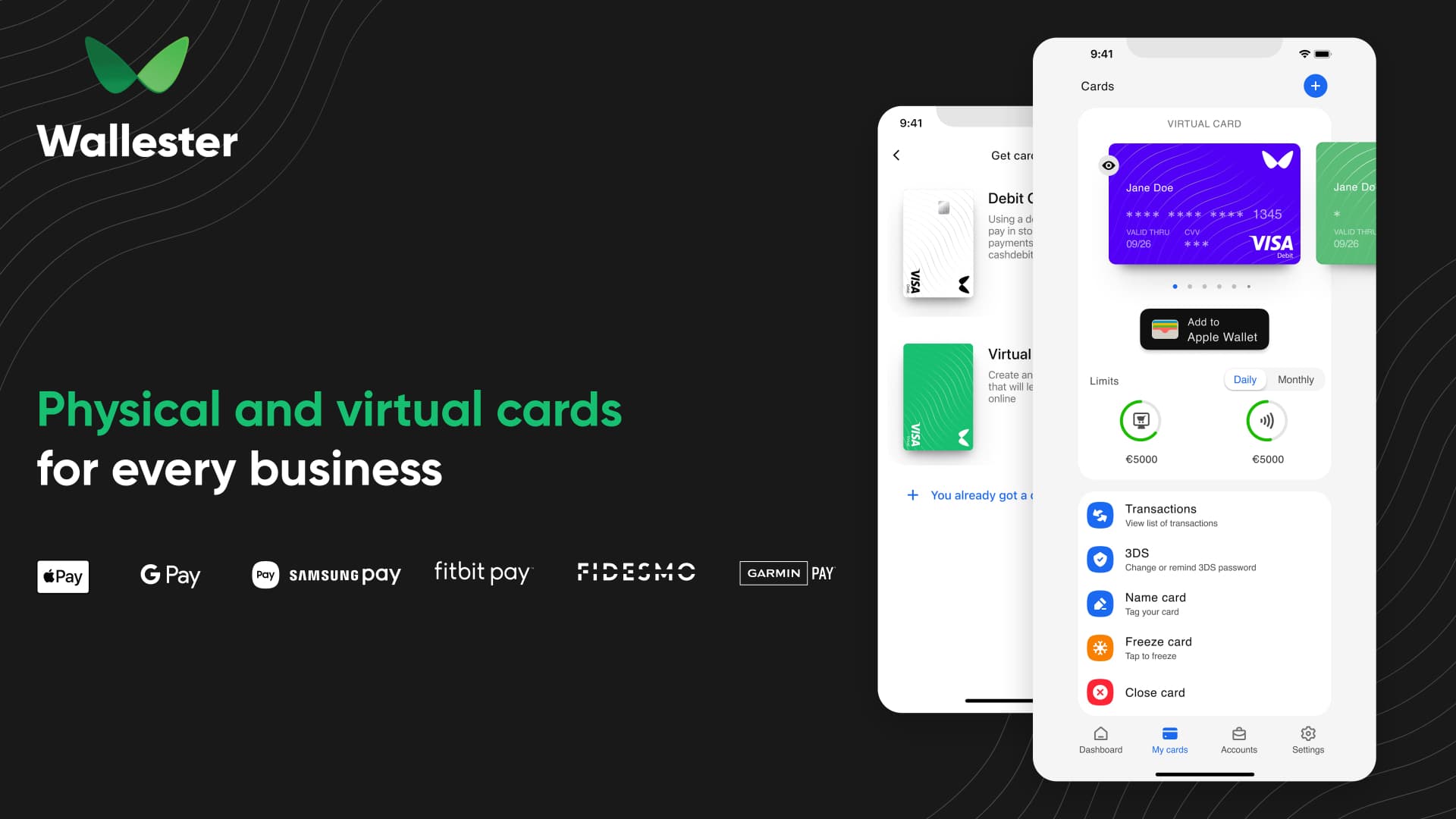

Wallester is a fintech platform that offers comprehensive solutions for issuing and managing virtual and physical corporate cards. It provides:

- Businesses with real-time expense tracking

- Customizable spending controls

- Seamless integration with accounting systems

Who benefits most? Three big groups:

- Media Buyers: You’re running ads on Facebook, Google, TikTok? Wallester gives you instant virtual cards for each campaign. No waiting, no hassle.

- Finance Managers: You want live updates on spending, tight controls on budgets, and a system that actually talks to your accounting software. Wallester delivers.

- Fintech Developers: If you’re building apps and need a reliable API for card issuing, Wallester’s got you covered, no surprises, no headaches.

Why is this review trustworthy?

This review is based on extensive testing of Wallester's features, which include API performance, card issuance speed, pricing transparency, real-world experiments, and comparisons with competitors like Ramp to provide a comprehensive overview.

Wallester for Media Buyers

Q: Is Wallester good for media buying?

A: Yes, for media buyers specifically, Wallester is a solid choice; it works with major ad platforms like Facebook, TikTok, Google Ads, etc.

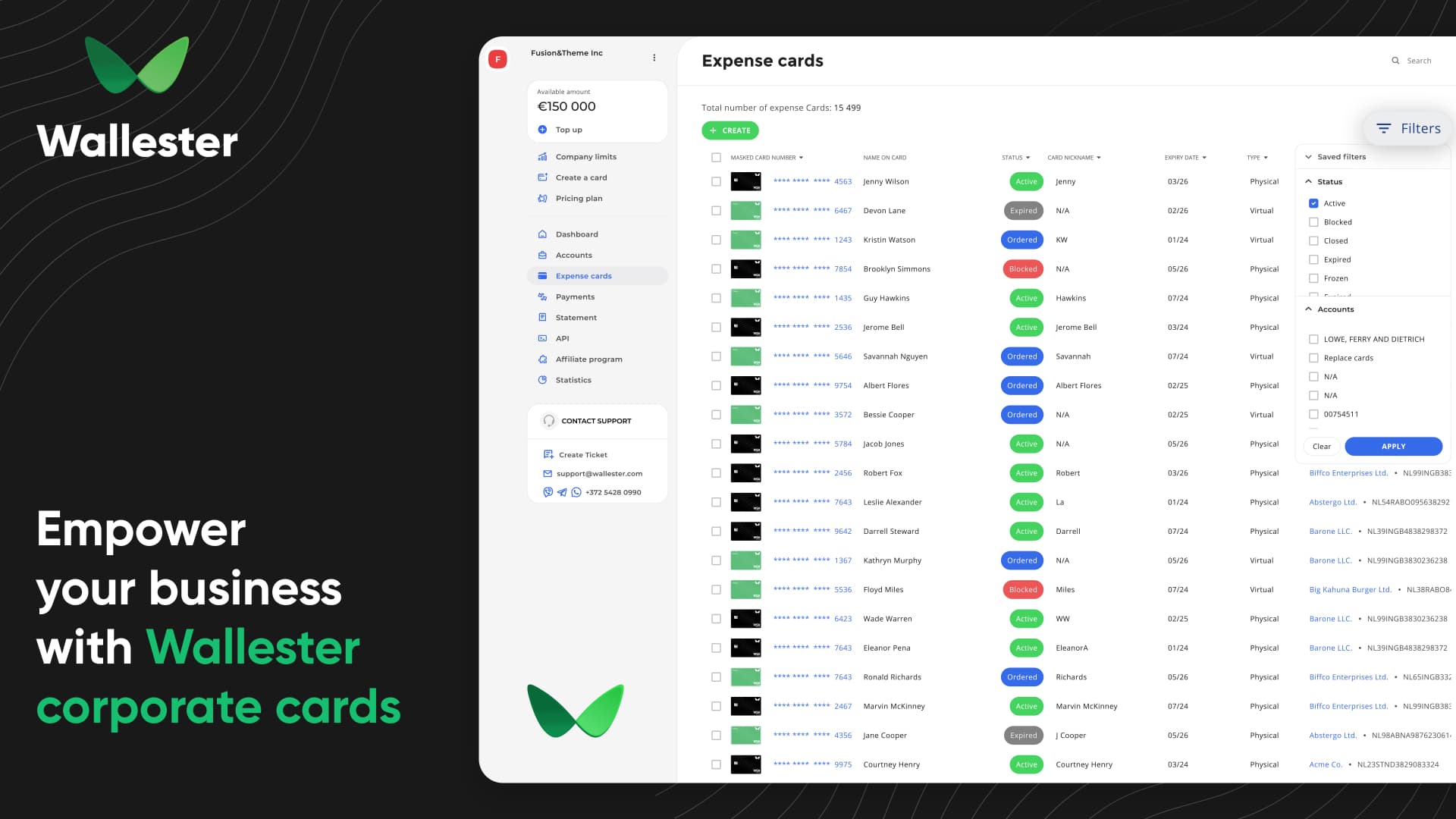

- You can create virtual cards instantly, set campaign-level budgets, and track everything in real time.

- Assign cards to team members, adjust limits on the fly, and keep spending in check.

If you encounter vendor issues, some ad platforms require you to pre-approve cards. Wallester’s free whitelisting tool makes that a breeze.

Card Generation Speed Test:

- Test: Issued 10 virtual cards in under 30 seconds.

- Result: Instantaneous card creation with real-time balance updates.

Vendor Issues & Workarounds:

- Issue: Some ad platforms may require manual whitelisting of credit cards.

- Workaround: Utilize Wallester's free whitelisting feature to pre-approve card usage across multiple platforms.

Talk with us for a free 15-minute consultation

Wallester Media

Wallester Screenshots

Wallester for Finance Teams

Q: How does Wallester support finance managers?

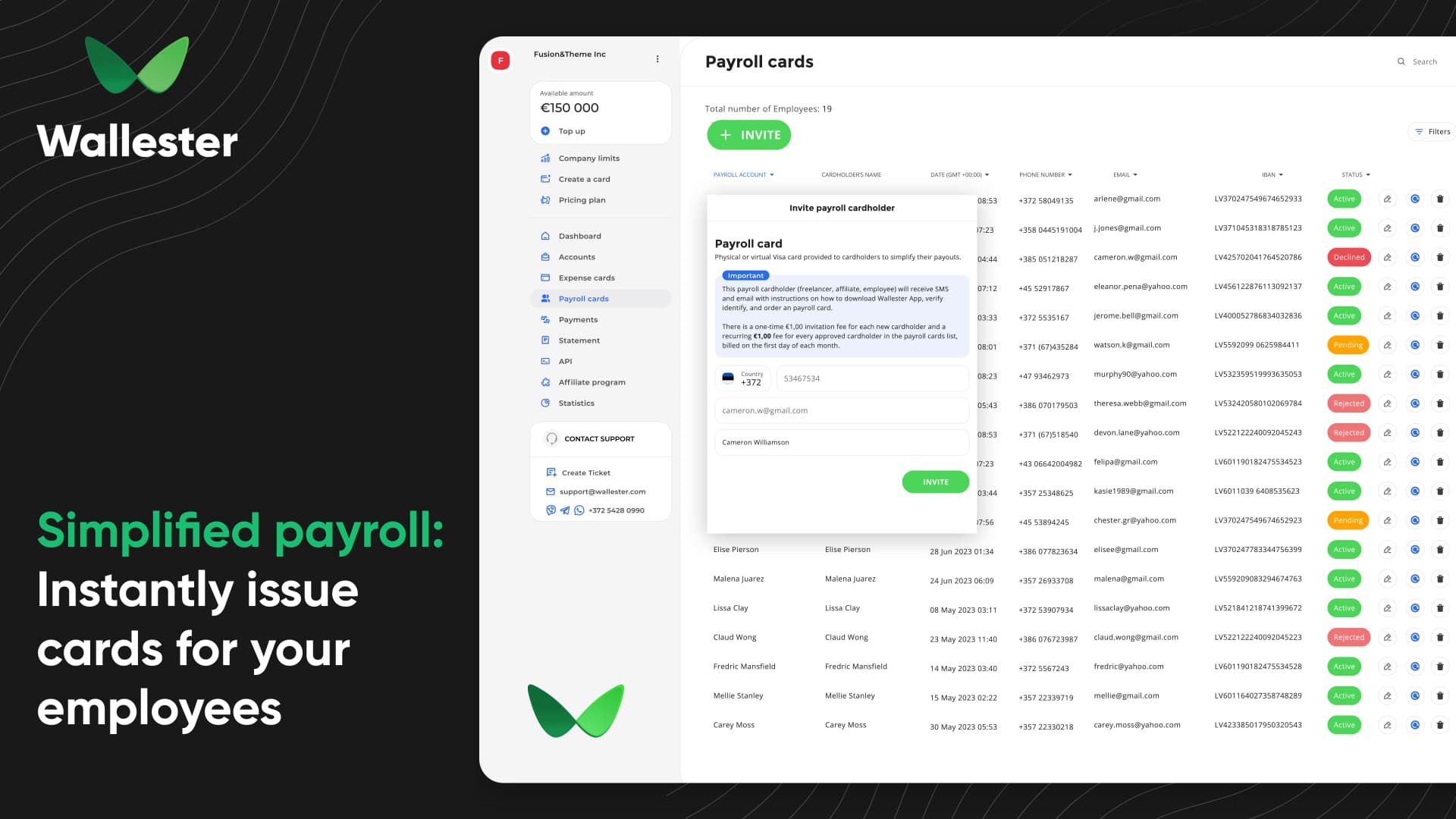

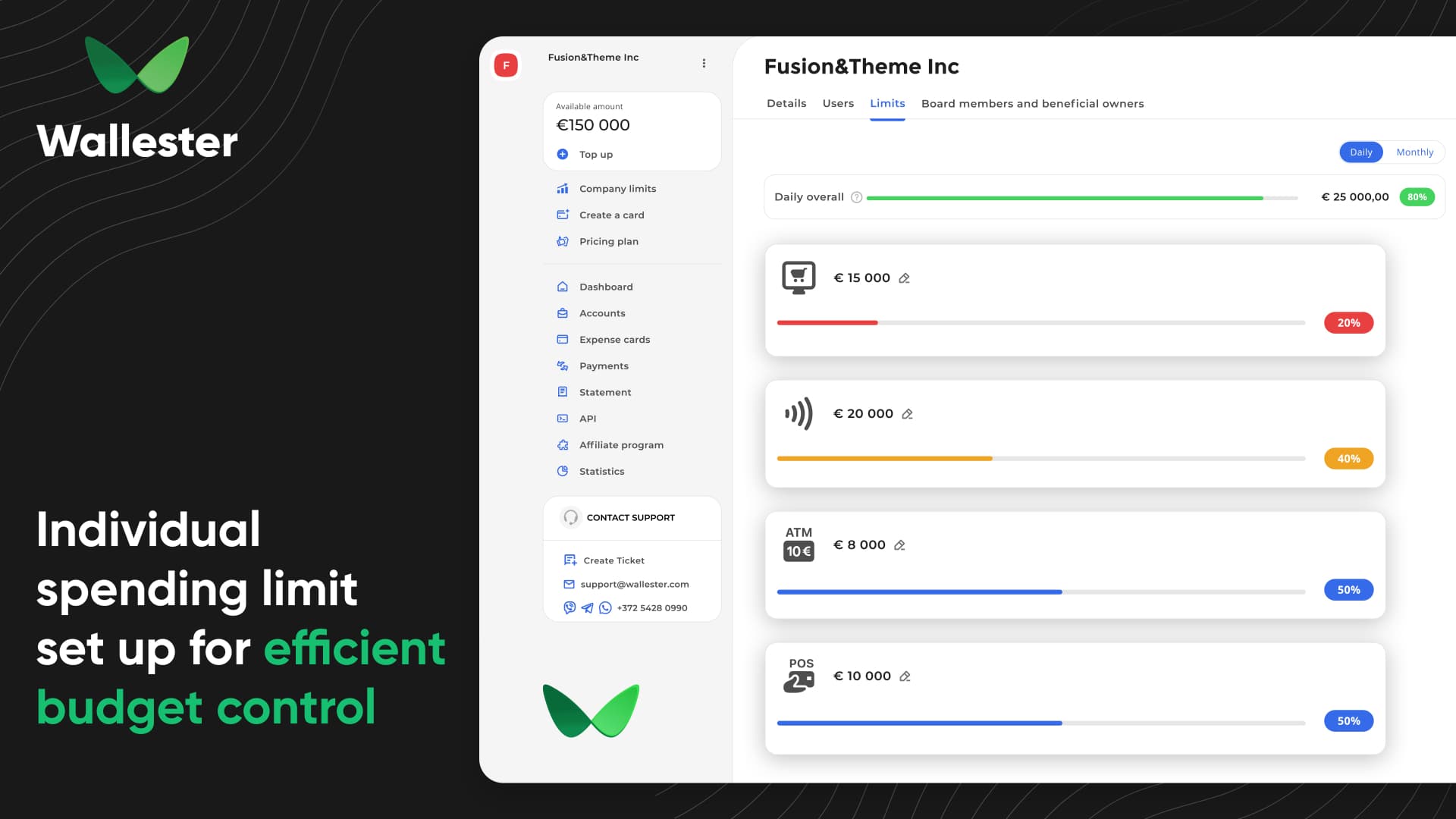

Ans: Wallester streamlines expense tracking and delivers real-time reporting, giving managers tighter control over budgets and spending, thereby decreasing the manual process of reconciling them and improving the overview of expenses.

Customizable spend controls mean you can set card limits, assign cards by department, and instantly freeze or cancel if needed. The days of manual reconciliation and endless spreadsheets? Pretty much over, Wallester automates the busywork and gives you a clear financial snapshot at any time.

Wondering if Wallester is right for your organization? Our Expense Report Software selection experts can help you in 15 minutes or less.

Automated vs Manual Expense:

Manual: Managing expenses this way means sifting through piles of receipts and entering data by hand into spreadsheets. It’s tedious, eats up valuable time, and let’s be honest, mistakes are almost guaranteed.

Wallester: Expenses are automatically categorised, and detailed reports are generated in real time, freeing up your team for more strategic work.

Reporting Performance Measurement:

Monthly report for 50 transactions? Wallester delivers in under two minutes, with every transaction categorised for easy review.

Test: Reviewed a monthly expense report for 50 expenses.

Outcome: The report was produced in less than 2 minutes and was well categorised.

Permission and Control Features:

- Establish distinct spending limits for every card.

- Assign cards to particular projects or departments.

- Freeze or cancel a card instantly through a user-friendly dashboard.

Sign up for Wallester and automate your expense management today.

API and developer experience.

Q: What is Wallester’s API like?

A: Wallester’s API is fast, stable, and developer-friendly, with low latency and a sandbox environment for testing. It allows for instant card issuance, the ability to check balances, and retrieve information for transactions; however, there were no advanced integration examples for some of the more advanced features.

Latency Metrics & Stress Tests:

Test: Successfully issued 100 virtual cards simultaneously via the API.

Outcome: All 100 virtual cards were issued into the system within 5 seconds, with zero errors or timeouts.

Test: Successfully issued 100 virtual cards simultaneously through the API. Outcome: All 100 virtual cards were issued into the system within five seconds, with no errors or timeouts.

Documentation gaps:

The documentation covers the basics well; API reference is organized, authentication steps are clear, and endpoint info is all there. But honestly, it’s a little thin on practical integration examples. If you’re hoping for real-world code snippets or anything for multi-tenant setups, you’ll be left wanting. The section on webhook retries? Needs more detail, no question.

Integration & Support:

Integration-wise, legacy systems might need some extra elbow grease, but Wallester’s developer support is impressive. There’s a help centre, API forums, and live chat that actually responds fast, usually under five minutes. Most integrations are wrapped up within two weeks, which is efficient for this space. Developers report a smooth onboarding experience, though enterprise clients definitely benefit from extra technical guidance.

Customization vs. Out-of-the-Box:

On the customization front, you’ve got options. Want to build your own logic, reports, or rules? Go for it. Prefer to plug into existing integrations with accounting or ERP platforms? That’s ready out-of-the-box. Instantly issue virtual cards, track expenses, export reports, and the basics are covered. For those after a tailored solution, it’s easy to embed Wallester cards or develop white-labeled financial services.

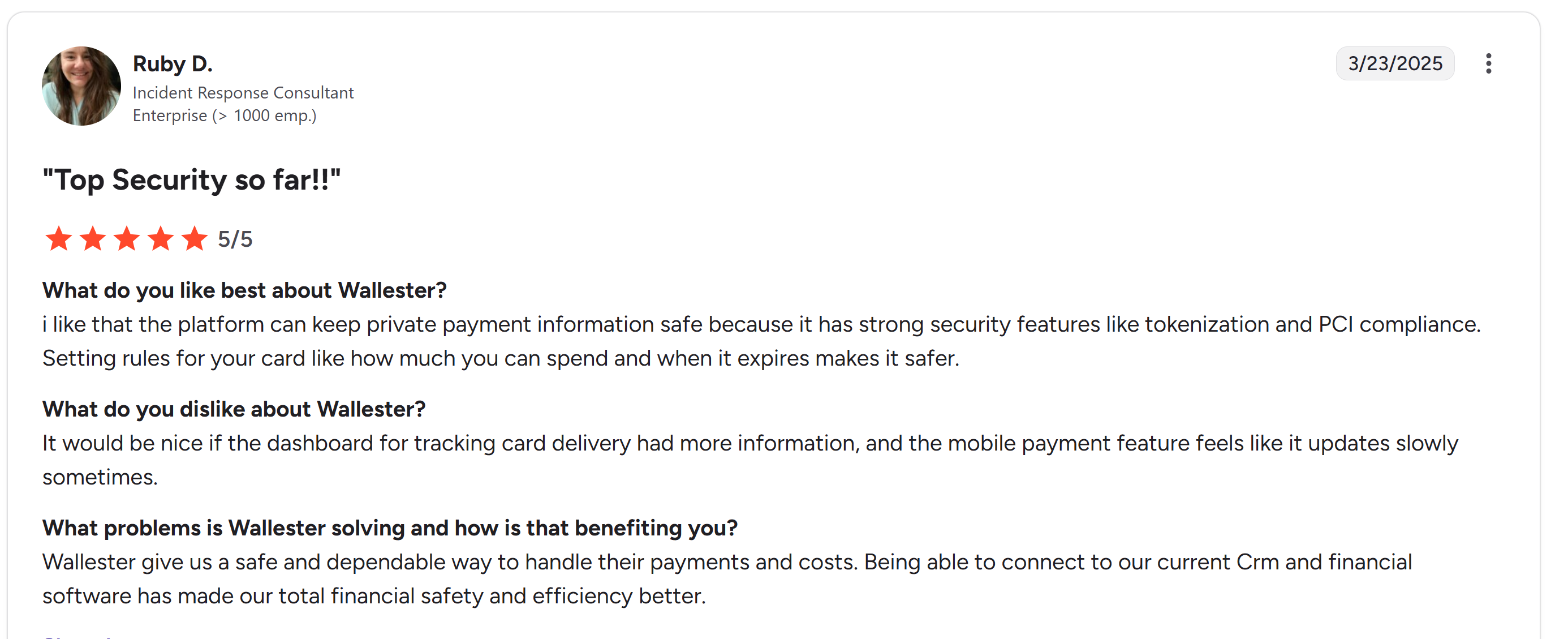

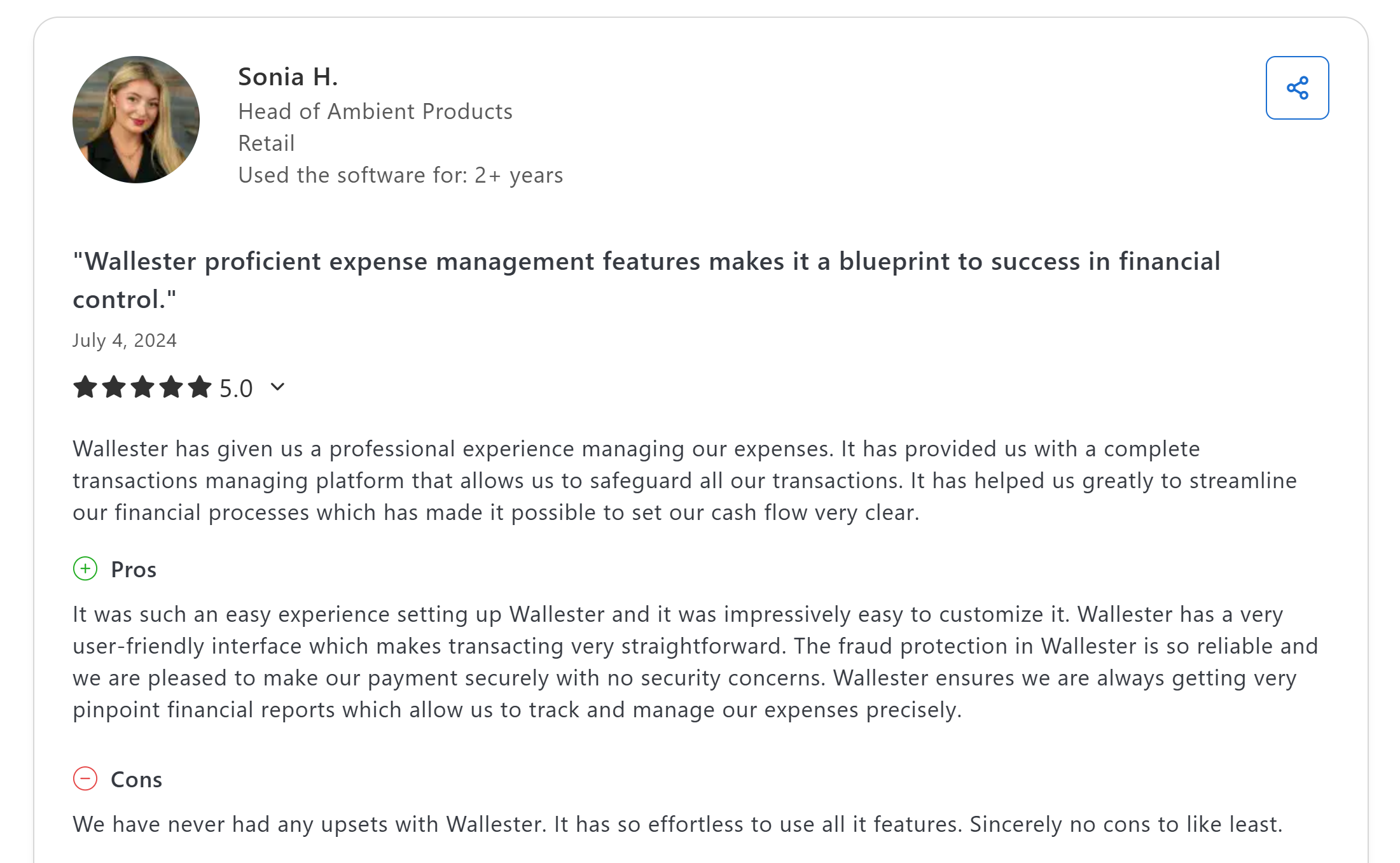

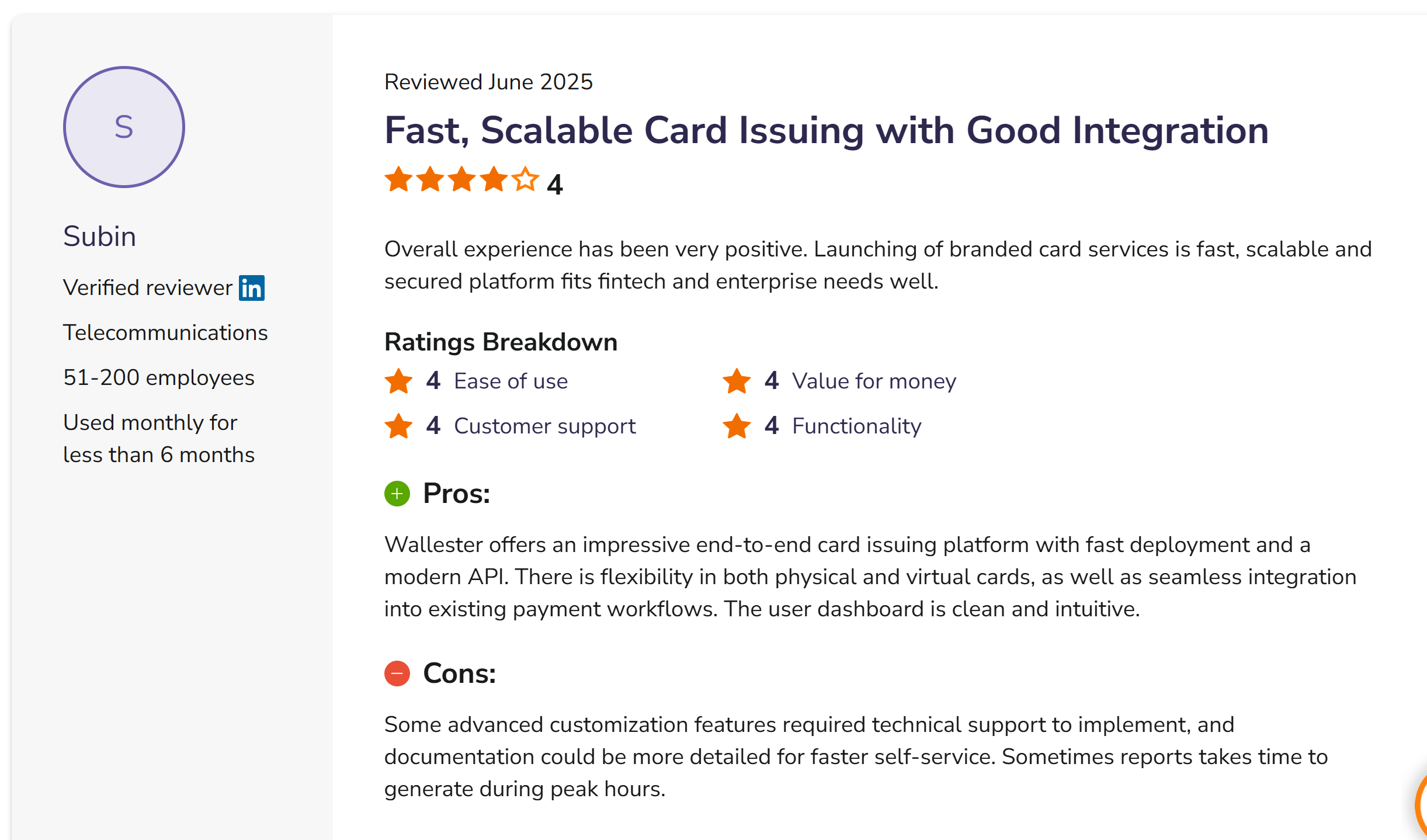

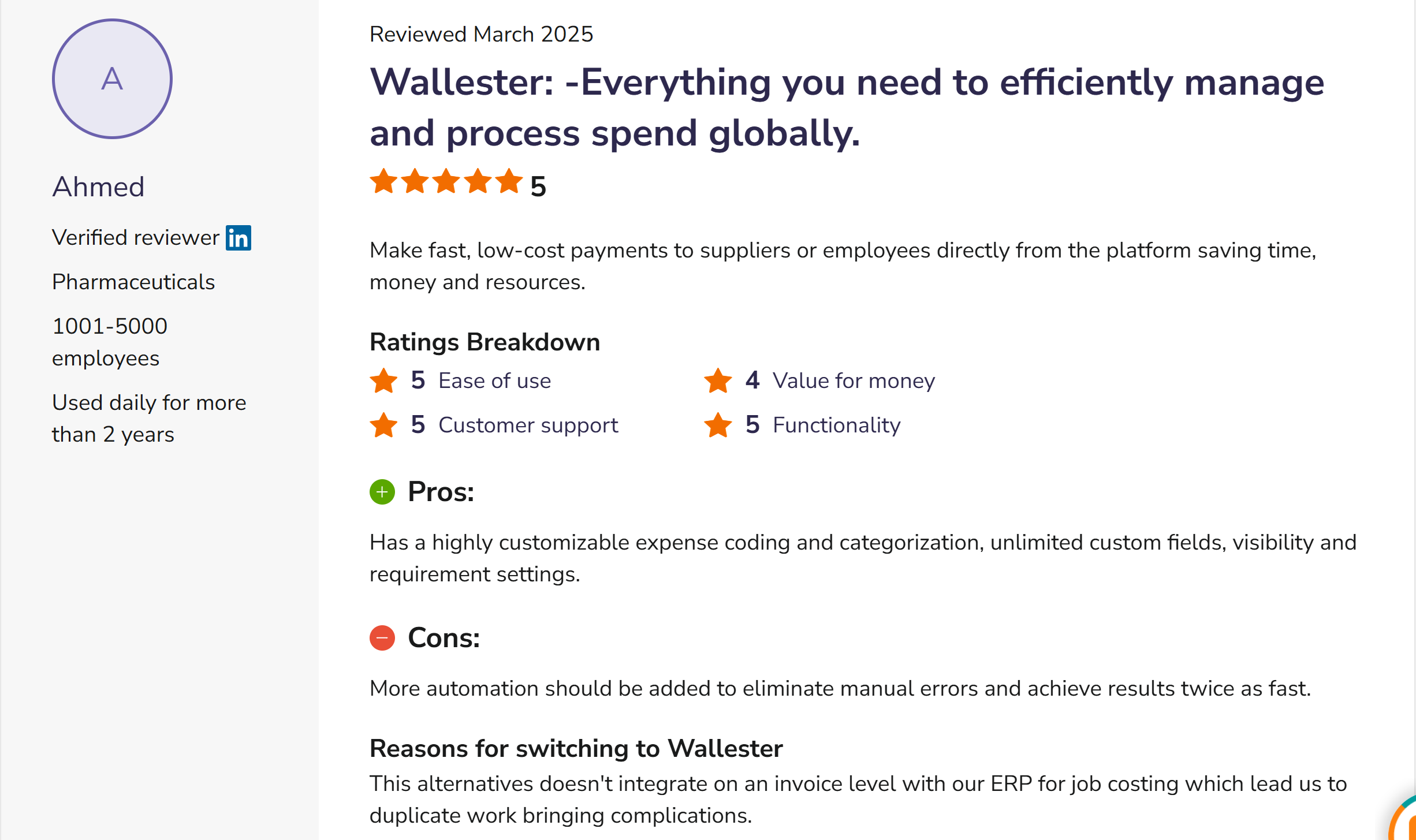

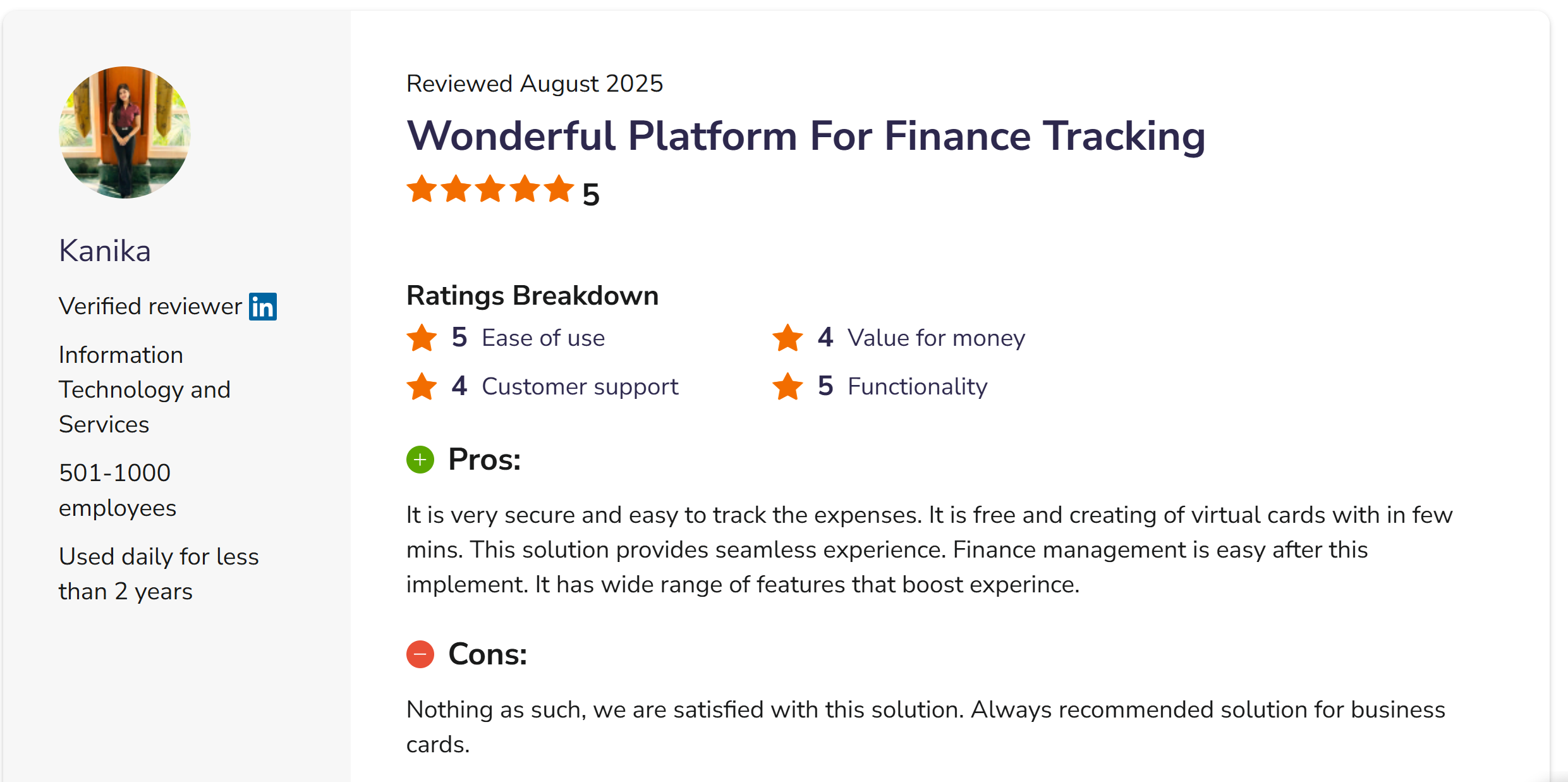

Wallester Reviews

Pricing & Fees - Straightforward & Transparent

Q: Any hidden fees with Wallester?

A: None. Seriously, there’s no catch. No surprise costs for issuing cards, letting them sit idle, or closing your account. FX fees come in at a reasonable 1.8%. And you’re allowed up to 300 cards on the free plan, which is pretty generous.

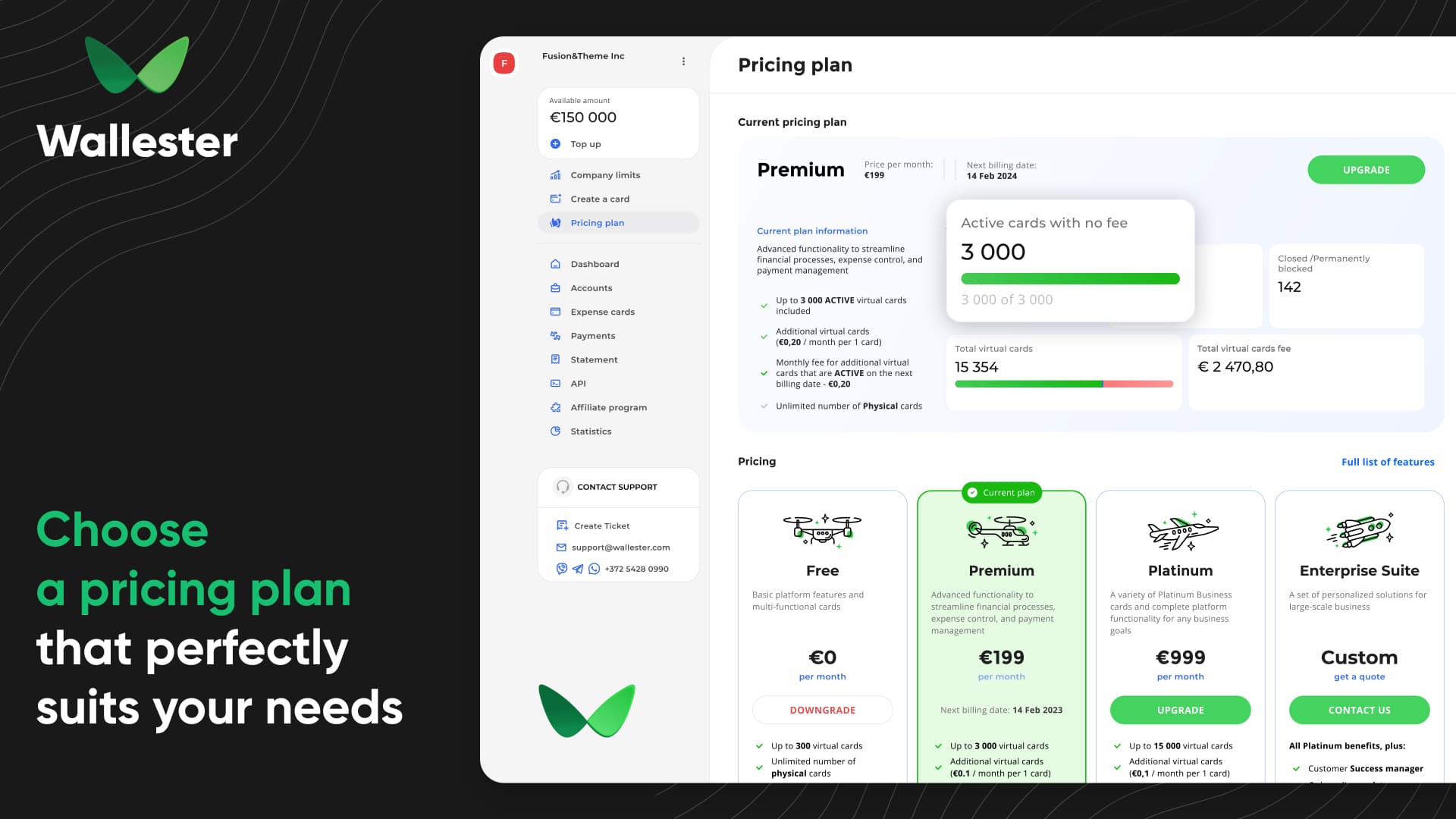

Plans at a Glance:

- Free Plan: €0/month. You get 300 virtual cards to work with, plus as many physical cards as you need.

- Premium Plan: €199/month. This one scales up: 3,000 virtual cards, plus deeper features like accounting integrations and advanced analytics.

- Platinum Plan: €999/month. Go big: 18,000 virtual cards, a dedicated relationship manager, and hands-on onboarding for a smooth start.

Other Fees You Should Know:

- ATM Withdrawals fee: 2% (minimum €2 per withdrawal)

- Bank Transfer Top-Up: No charge

- Top-Up by Credit/Debit Card: 1.2%

- Currency Exchange: Visa’s rate plus 2%

If you want to see the details side-by-side, Wallester offers a helpful comparison so you can choose confidently.

Compare Wallester's pricing plans and choose the best fit for your business.

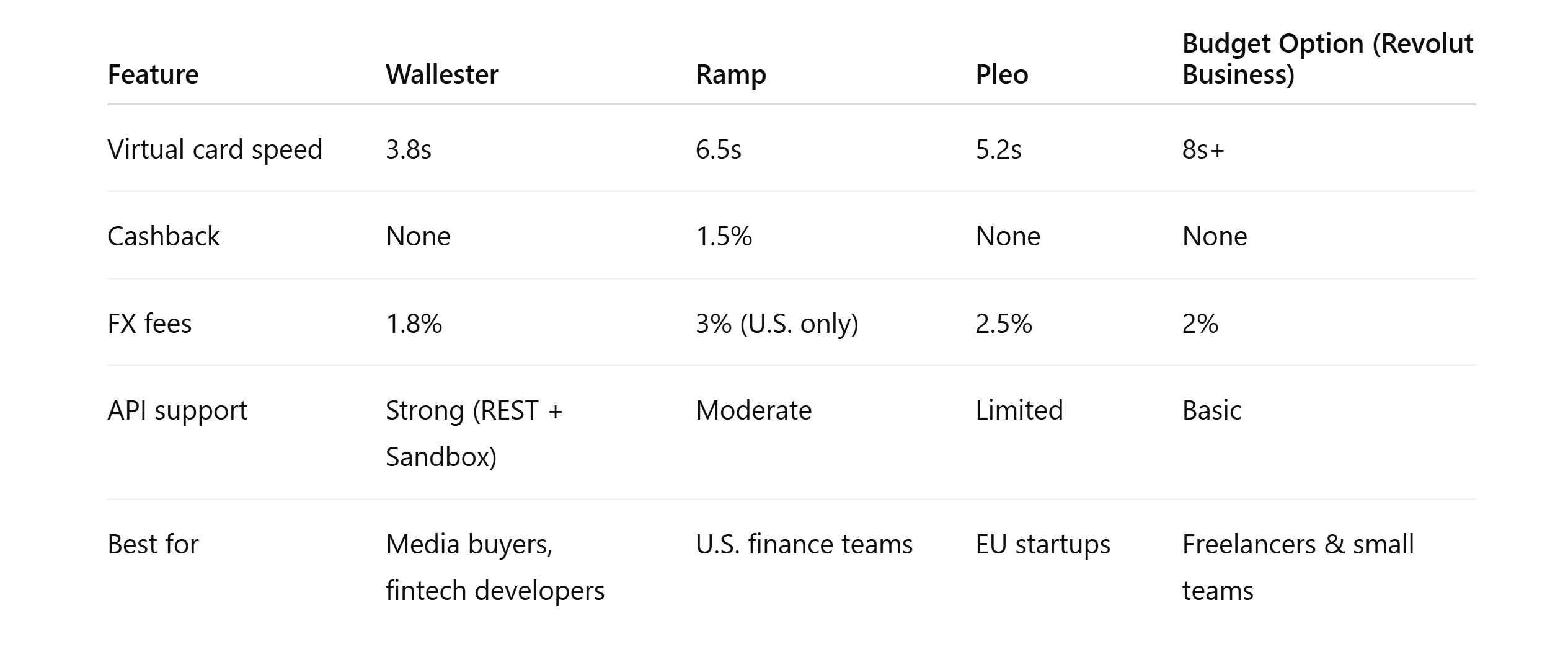

Wallester vs. Ramp: Which Solution Fits Your Business?

Q: Should you pick Wallester or Ramp?

A: Here’s the gist. If your team operates internationally, media buying, fintech, or similar, Wallester stands out for fast virtual card issuance and flexible API support. For U.S.-based companies focused on maximising cashback and automating accounting, Ramp will likely meet your needs better.

Key Comparison Points:

- Virtual Card Issuance: Wallester is instant; Ramp is fast but not quite as rapid.

- API Flexibility: Wallester offers more flexibility; Ramp is serviceable but less customizable.

- International Use: Wallester is built for it; Ramp’s focus is the U.S.

- Cashback: Ramp offers it; Wallester does not.

- Accounting Integrations: Both platforms provide them.

- Transparency: Both are upfront about pricing.

Who should be looking at alternatives?

- If your company mainly operates in the U.S. and you’re chasing cashback rewards, Wallester might not be your best bet.

Honestly, do a thorough feature comparison before you commit. No harm in making sure you get the right fit.

Getting started with Wallester

Tired of complicated payment processes? Wallester provides practical, business-focused solutions that actually fit your company’s needs. If you’re interested, simply connect with their sales team using the link in this review.

Just share your contact details, a bit about your business, and outline what you’re aiming to achieve. The onboarding is quick and straightforward. Honestly, you’ll be set up in no time, so you can get back to focusing on the bigger picture.

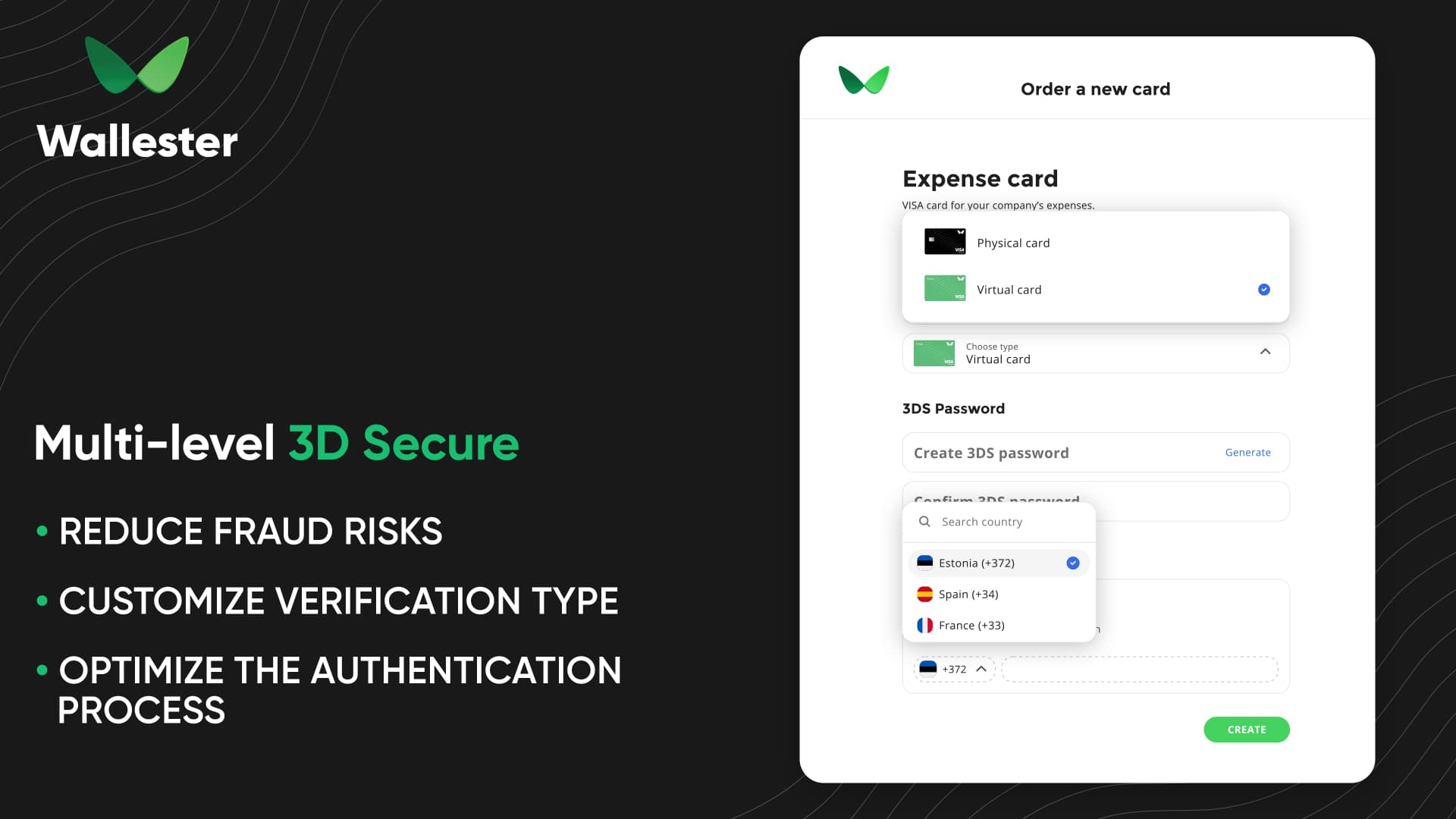

Is Wallester Safe? Absolutely! - A Trusted Platform

Security isn’t something they take lightly; this has been their utmost priority. Wallester operates under the oversight of the Estonian Financial Supervision and Resolution Authority, so their compliance is by the book, not just in Estonia, but in the UK and other regions of operations as well.

Final Verdict

Here’s the deal - Wallester’s loaded with a comprehensive suite of features tailored for different businesses to succeed, whether you’re media buyers running digital campaigns, finance managers managing budgets, or fintech developers developing fintech solutions. It is observed that Wallester's instant virtual card issuance, robust API, and transparent pricing make it a compelling choice for businesses seeking to streamline their corporate spending and ensure accountability.

Tailored Recommendations:

- Media Buyers: Create your first virtual card now and optimize your ad spend.

- Finance Managers: Sign up for Wallester and automate your expense management.

- Fintech Developers: Explore the API documentation and start building your fintech solution.

Start your free Wallester trial today and experience seamless corporate spending.