Finance

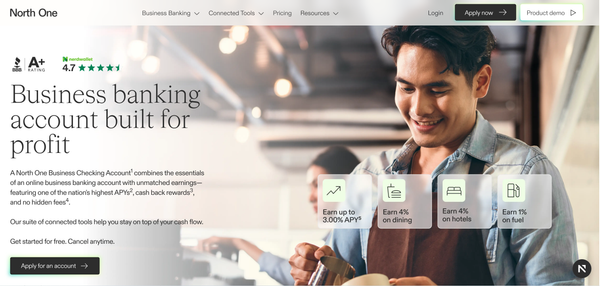

Stop Waiting: NorthOne's Instant Payouts End Your SMB Cash Flow Crisis and Free Spend Management

Tired of 3-day holds on your Stripe or PayPal payouts? NorthOne is engineered to eliminate the SMB cash flow crisis, giving you instant access to revenue from payment processors. Plus, earn up to 3.00% APY